Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

You are newly retired, so now what? We hear all our lives about the importance of saving, but nobody talks about how to withdraw money after you retire. We are going to cover how to make withdrawals from your 401k or TSP account in retirement.

No. Most employer-sponsored retirement savings plans are pre-tax, meaning you owe taxes on any money withdrawn from the account. If you withdraw all the money at once, you will have a huge bill. You would spend way more on taxes than if you had taken a little each year.

Our tax system is progressive, meaning the more taxable income you have, the greater the percentage that gets taxed. For example, a small withdrawal from your retirement savings might be taxed as little as 10%, but a large withdrawal could be taxed as much as 37%. That is why it would be foolish to withdraw all of the money from your retirement savings at once.

Even if you think your employer was inept and made poor business decisions, you still shouldn’t withdraw all of your savings when you retire. The company you worked for has nothing to do with the security of your retirement savings. Your retirement savings are held by a financial institution, not your employer. The financial institution which holds your retirement savings is heavily regulated by the federal government.

No. When you are contributing to your employer-sponsored retirement plan during your working years, everything is essentially on autopilot. You decide the percent of your pay to go towards retirement savings and it gets automatically withheld from your paycheck. You might assume that it works kind of the same way in retirement, but it doesn’t.

If you want to receive periodic withdrawals from the financial institution that holds your 401(k) or TSP, you have to decide how much and when. It takes some knowhow to make those decisions, which we will cover in a minute.

That would be stupid. Why save for retirement if you’re not going to use it? Think of all that money you saved. If you were never going to use it, why save it? You would have been better off spending it back when you were younger and better able to enjoy it.

Besides, you will quickly learn that Social Security is not sufficient to maintain the typical American lifestyle. Social Security was never meant to be a retiree’s sole source of income. Social Security is designed to supplement your retirement income. Use your retirement savings, that’s what they're for.

It takes a bit of work to determine the best way to withdraw money from your retirement savings. If you withdraw too much too soon, you will run out of money. If you withdraw too little, you will be strapped for cash and leave too much unused savings in your account.

Like everything these days, most people turn to the internet for answers. Perhaps that’s how you found this article. There are many simple retirement calculators available – just google “Retirement Calculator." They are all pretty much the same. You enter your age, income, and savings, and they spit out an answer.

Simple retirement calculators are based on retirement rules of thumb. One is the 4% rule of thumb which says you should withdraw 4% of your retirement savings each year. Another is the 80% rule of thumb which says your living expenses in retirement will be 80% of your pre-retirement living expenses.

Both rules of thumb are fundamentally flawed, and as an aside, why would anyone base something as important as their retirement on a rule of thumb? Retirement rules of thumb fail to consider numerous important factors, such as:

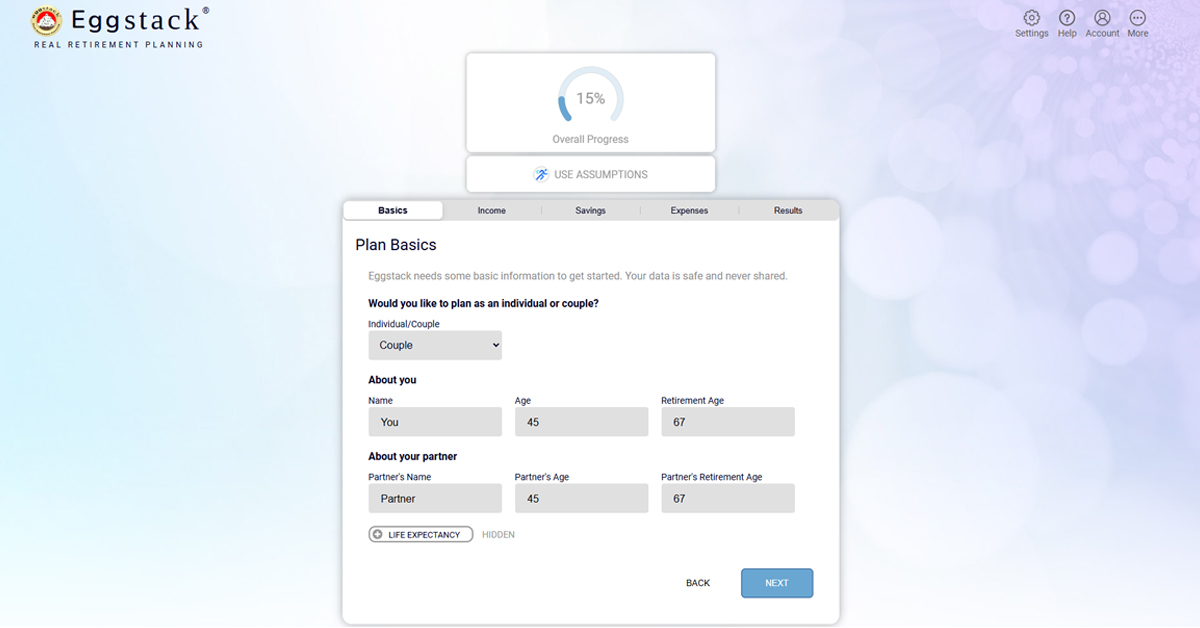

The best way to determine how to withdraw money from your retirement savings is to hire a certified financial planner, or use retirement planning software. Programs like Eggstack are designed to be used by everyday people just like you.

Eggstack has a simple interface that walks you through the process step-by-step. Don’t be intimidated by the thought of self-directed retirement planning. If you can answer a question, you can use retirement planning software.

Most Americans spend more time planning a single vacation than they do their entire retirement. Take an important step to securing your financial future and start your free plan today.

Photo credit: Storyblocks

Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

Photo credit: Storyblocks

Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.