Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

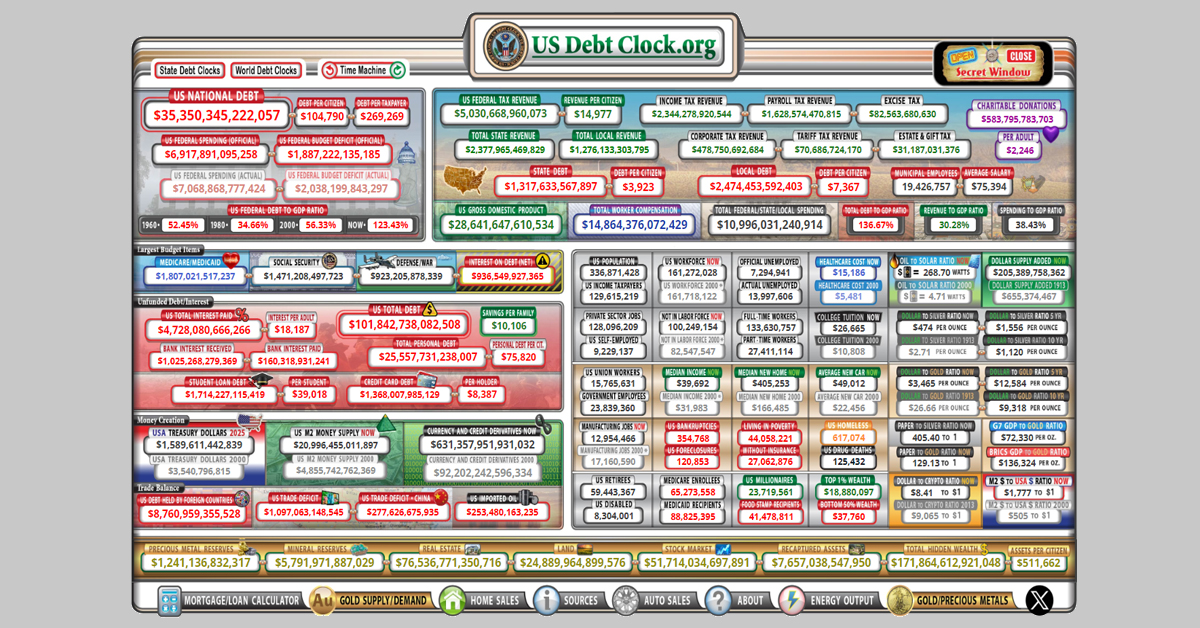

The U.S. national debt stands at $35,000,000,000,000 ($35 trillion) and counting. You can see a live view at U. S. Debt Clock. Our total annual federal tax revenue is $5,000,000,000,000 ($5 trillion). That means our outstanding debt is 7x annual income.

These numbers are too big to comprehend. However, if we scale them down in proportion to an average American household, we can see what it’s like to spend money like the federal government. Mean U.S. household income is about $80,000. Based on that, if the average household spent money like the federal government, it would be close to $600,000 in debt.

The government’s sole source of income is taxes. It's collected directly in the form of income taxes and indirectly through corporate taxes and other taxes. Either way, we pay for it. Corporate taxes get passed on to the consumer in the form of higher prices.

The budget deficient we hear about in the news is often confused with the national debt. The budget deficient is the amount the federal government spends each year that exceeds tax revenue. The national debt is the total amount the federal government owes. The debt is comprised of past and present budget deficits plus accrued interest.

Spending at the federal level is alarming. Our leaders need to balance the budget and eliminate the national debt. Each year we waste billions of dollars on interest. Last year we spent a record $650 billion on interest and that figure goes up each year.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.