Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

How much do you need to save for retirement? It all depends on your lifestyle. If you plan to live a lavish lifestyle, you need a lot. If your retirement plans are simple, then not so much.

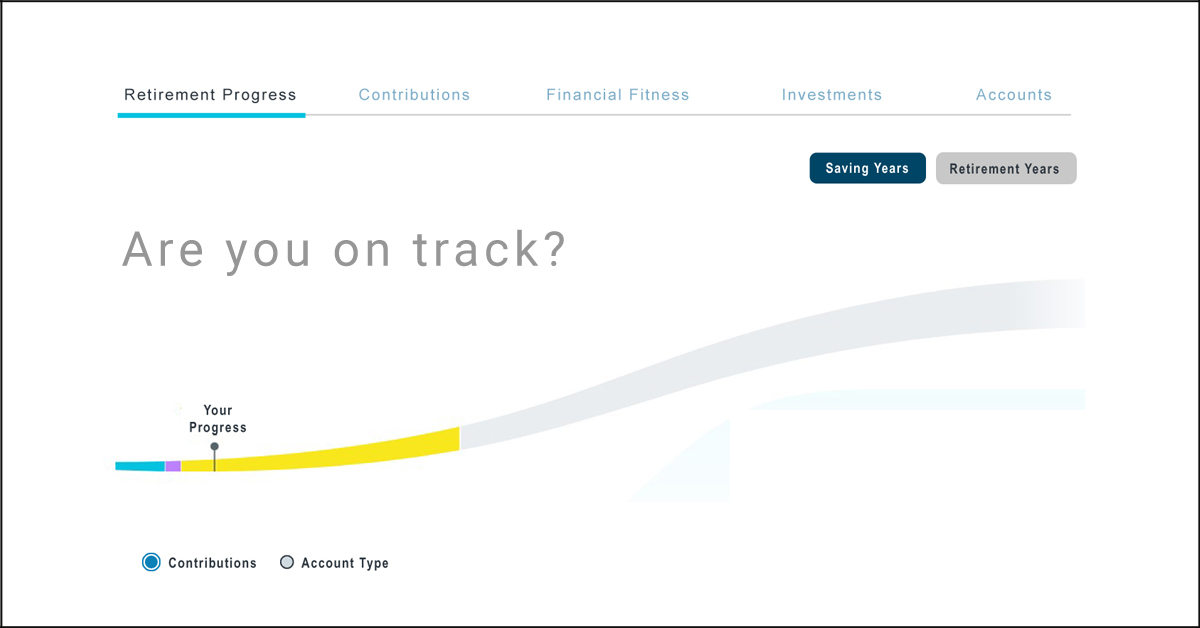

The 80 Percent Rule is the most commonly-used retirement rule of thumb. Chances are your financial institution’s website proudly displays its result on their home page. This simple rule of thumb drives the chart that for most people is the entire basis of their retirement planning. You know the one: Are You on Track? The 80 Percent Rule is also widely used by financial planners and free online retirement calculators.

The 80 Percent Rule is the theory that you should save enough for retirement to replace 80 percent of your pre-retirement income. The 80 Percent Rule is based on two facts and three assumptions:

TWO FACTS:

THREE ASSUMPTIONS:

Fact 1: Once you retire, you will no longer have payroll taxes.

If you look closely at the paystub you receive from your employer, you will see amounts withheld for FICA, MED, and OASDI. These are commonly referred to as payroll taxes.

FICA stands for Federal Insurance Contributions Act, MED is short for Medicare, and OASDI stands for Old Age, Survivor, and Disability Insurance. When you retire, payroll taxes will no longer be withheld from your paycheck because you won’t have a paycheck.

Fact 2: Once you retire, you will no longer need to save for retirement.

It should come as no surprise that once you retire, you will no longer save for retirement.

That takes care of the two facts. The three assumptions require a bit more discussion. I almost said the devil is in the details. I hate that saying. Same with six on the one hand and half dozen on the other, and at the end of the day. In fact, here’s a list of things no one anywhere should ever say for any reason:

Apples-to-apples

Bang for the buck

Been a minute

Big ask

Circle back

Deep dive

Dope

Ducks in a row

Elephant in the room

Game changer

Get the ball rolling

I hear you

Just saying

Low-hanging fruit

No brainer

Not rocket science

Par for the course

Stoked

There are no words

To be perfectly honest with you

Touch base

Train wreck

Win-win

Why can’t we just speak English? Don’t you feel sorry for people coming here from other countries? How can they possibly know what’s going on? Can you imagine the conversation after their first day at work?

“It's been a long day. This one guy wanted to take a deep dive and touch base. I’m not sure what that is, but I don’t like the sound of it. If I won’t let him he said he's going to drill down and pick my brain. I’m glad I missed the dog and pony show, I’m pretty sure they were beating a dead horse. Mostly everyone just lied to me. Once in a while someone would say, ‘To be perfectly honest with you…’ then they would finally tell me the truth. Oh, did you hear about the train wreck?"

The First 80 Percent Rule Assumption

The first 80 Percent Rule assumption, that you will spend less on everyday things after you retire, is based on a number of factors. Your daily commute will be eliminated, you may go out to lunch less often, have fewer dry-cleaning bills, and less clothing purchases.

That theory was obviously postulated before the pandemic. While it is true that many people no longer work from home, some people still do. With regard to dry-cleaning bills, clothes today don’t require as much dry cleaning as they did when this rule of thumb came to be.

Let’s assume for a minute that the first assumption is true. What the 80 Percent Rule of thumb doesn’t take into account is that any such savings are likely offset by other costs that increase in retirement, such as healthcare, travel, and hobbies.

The Second 80 Percent Rule Assumption

The second assumption, that you own your home and the mortgage will be paid off by the time you retire, is also questionable. Some people get a late start and do not purchase their first home until they are middle-aged. Some folks keep trading up for bigger homes, always with a 30-year mortgage. A lot of people take out a second mortgage on their home which puts them further from ever paying off their home. Then there are those who never purchase a home and rent all their lives.

A study found that one-third of Americans age 65 and older still have a mortgage, and the average balance is over $100,000. So much for the second assumption.

The Third 80 Percent Rule Assumption

The third assumption, that your taxes will be lower in retirement, seems logical on its face. After all, you won’t be working anymore. But you still need income to meet your living expenses.

Where will that money come from? Retirement account distributions and Social Security retirement benefits. Guess what? They’re both taxable.

For most people, the primary goal is to take the lifestyle they enjoyed while working and carry it into retirement. In order to do that, you need the same level of income. The fact is, your tax rate in retirement may be the same as it was when you were working.

All three assumptions used in the 80 Percent Rule are highly subjective. Also, the rule of thumb completely ignores retirement age and life expectancy. The 80 Percent Rule is defined as having enough retirement savings to replace 80 percent of your pre-retirement income. For how long? Isn’t that kind of important?

If someone retires at 55 and lives to 95, wouldn’t they need four times as much savings as someone who lives only 10 years after retirement?

The very notion that you should plan your retirement with a rule of thumb is preposterous. The best way to plan for retirement is to use sophisticated financial modeling software. Programs like Eggstack help you determine how much you need to save and when you can retire. Eggstack analyzes your unique situation and performs a year-by-year simulation on your financial model.

It’s your retirement and you’re going to be living it, shouldn’t you be the one planning it? Take an important step towards securing your financial future and start your free plan today.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.