Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

The recent collapse of Signature Bank and Silicon Valley Bank have exposed vulnerabilities in our banking system. Join us as we take a closer look at what is going on with our banks.

Not since the financial crisis of 08 has there been so much concern over the U.S. banking system. And for good reason. Until the day they failed, those banks had a Grade A rating from Moody’s. So what happened?

It’s no secret that the Federal Reserve has been raising interest rates to fight inflation. Rising interest rates are what triggered the banking crisis.

Banks don’t put deposits in a vault, they invest them. It’s a big part of how banks make money. A common investment for banks is the 10-year U.S. Treasury bond. It’s a safe investment that guarantees your money back with interest if you hold it until maturity.

Interest rates on 10-year bonds purchased after 2008 were very low. The low bond rates are not a problem if the bonds are held to maturity, but remember where banks get their money? Deposits. What happens when people want to withdraw money they deposited in the bank?

When withdrawals exceed cash on hand, banks have to liquidate assets. That means selling bonds before they mature.

The current interest rate on a 10-year Treasury bond is in the 3-4% range. If you were in the market to buy a bond, would you rather buy a new one with an interest rate in the 3-4% range or an old one with an interest rate in the 1-2% range? Older bonds with lower interest rates have declined in value. Selling them before maturity comes at a significant loss.

An unrealized loss is when an asset declines in value but has not yet been sold. These are “paper losses" by another name. Imagine you bought stock in Microsoft and it goes down in value. On paper you have lost money, but if you don’t sell and the stock goes back up, the paper loss disappears.

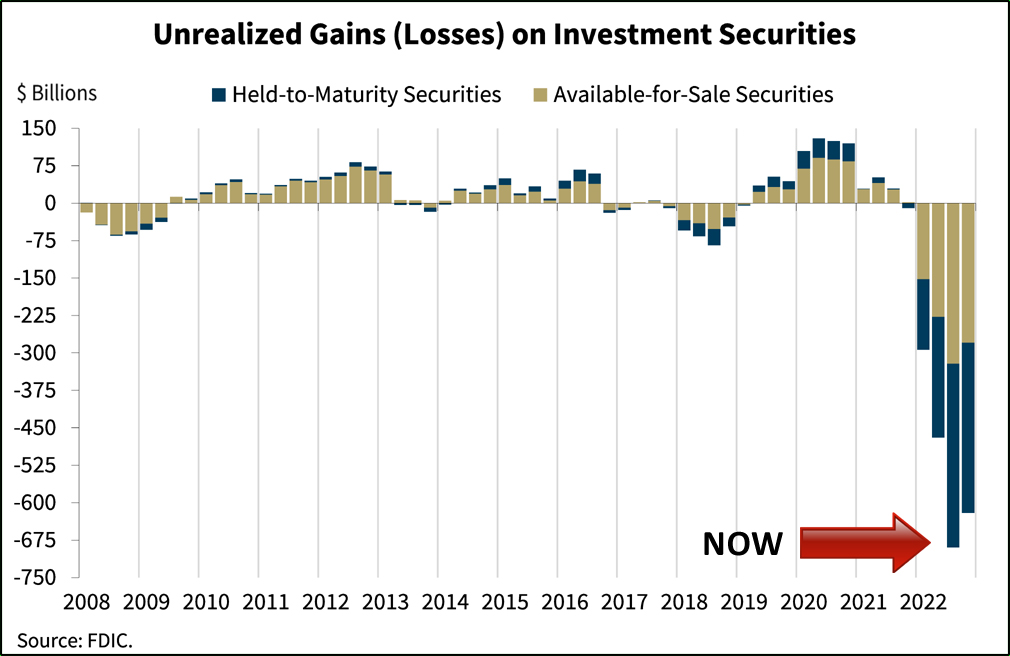

Banks are stuck in a 10-year bond trap. They bought billions of dollars worth of 10-year Treasury bonds back when interest rates were low. Now those bonds are worth significantly less than what they paid for them. How bad is it? Take a look at this chart from the FDIC.

U.S. banks are sitting on an estimated $620 billion in unrealized losses. Accounting standards do not require banks to report those losses on their book valuations. The truth is, the fair market value of most banks is vastly lower than their reported book value.

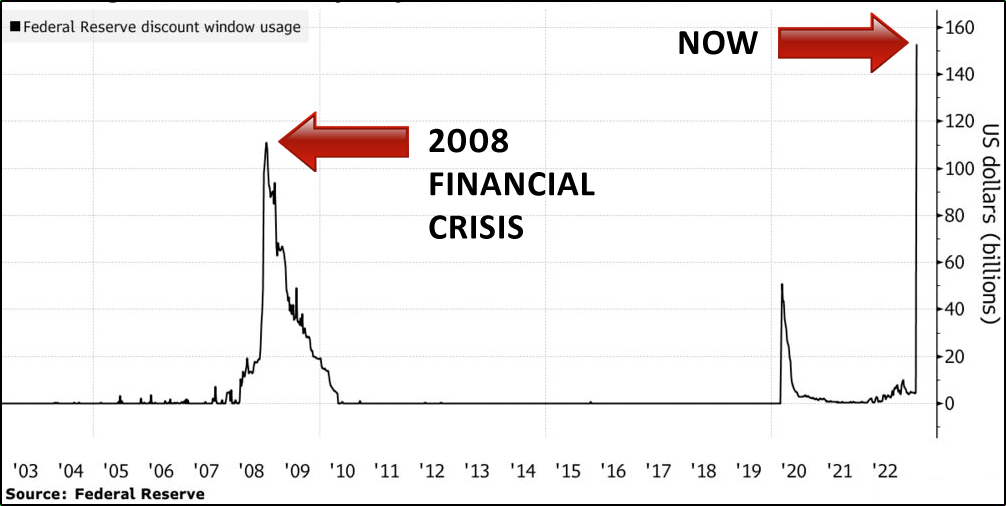

If that’s not enough to raise concern, U.S. banks just set a record in borrowing. Two weeks ago, banks borrowed $152 billion from the Federal Reserve discount window. That is more than ever before, including the financial crisis of 08. This chart from the Federal Reserve shows the record spike in borrowing.

In one week, U.S. banks borrowed 37% more than the previous all-time high of $111 billion set during the 08 financial crisis. To put that into perspective, the week prior they only borrowed $4.58 billion. That’s an increase of over 3000%.

If your humble blogger – an engineer turned financial buff – can figure this out, you would think that financial professionals whose job it is to run banks could see this coming. Interest rates after the 08 financial crisis were artificially low due to unprecedented action taken by the fed in the form of quantitative easing. Interest rates weren’t going to stay low forever. In that environment, who buys 10-year Treasury bonds that lock you into an artificially low rate for 10 years? Does that sound like a good investment to you?

Low interest rates and quantitative easing spurred economic growth that resulted in a strong bull market. From 08 until the fed started raising rates last year, the stock market was on a tear increasing 360%. $1,000 invested in the stock market during that period would have ballooned into $3,600. $1,000 invested in 10-year Treasury bonds during that same period would have increased to only $1,100. On a $1,000 investment over a 10-year period, would you rather earn $100 or $2,600? The banks chose $100.

Not only that, but it never occurred to bank managers that the artificially low rates would ever go back up. These are experts. They took our banks and ran them underground to the tune of $620 billion.

Don’t be too quick to dismiss this as a problem limited to a couple of poorly-run regional banks. While larger banks may be diversified to the extent that they would never need to liquify treasury bonds, big banks account for less than half of the banking biosphere.

According to the FDIC, small- and medium-sized banks account for 45% of consumer lending, 50% of commercial/industrial lending, 60% of residential real estate lending, and 80% of commercial real estate lending.

If, due to existential liquidity issues that we’ve outlined here, regional banks become reluctant to grant loans, it could have a devastating effect on the U.S. economy. Consumers and businesses need access to credit in order to keep our economy strong.

The U.S. banking system and by extension the overall economy are not in a good place right now. Does that mean you should withdraw all of your money and hide it under a mattress?

No. If you, like most people, have less than the FDIC-insured limit of $250,000 in the bank, you don’t have anything to worry about. You will not lose any money in the bank.

However, in the grand scheme of things, this is concerning. These bank failures could foreshadow bigger things to come. It’s food for thought given that economists are increasingly calling for a recession, and many believe we are already in one. It might be a good time to temporarily park your retirement savings in cash like we talked about in How to Protect Your 401(k) from Market Crashes. At the very least you should be cautious.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future. This article is for informational purposes only and is not financial advice or any other type of advice. Eggstack makes no representation to the validity, accuracy, completeness, or suitability of purpose of any information presented in this article.