Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

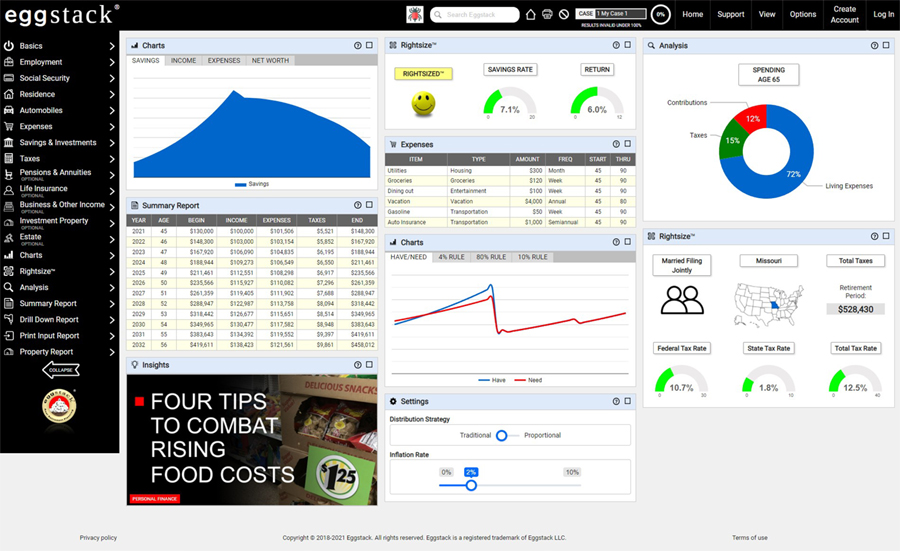

Big news: After years of development and testing, it’s finally here! Announcing the official release of Eggstack, the world’s most advanced retirement planning tool.

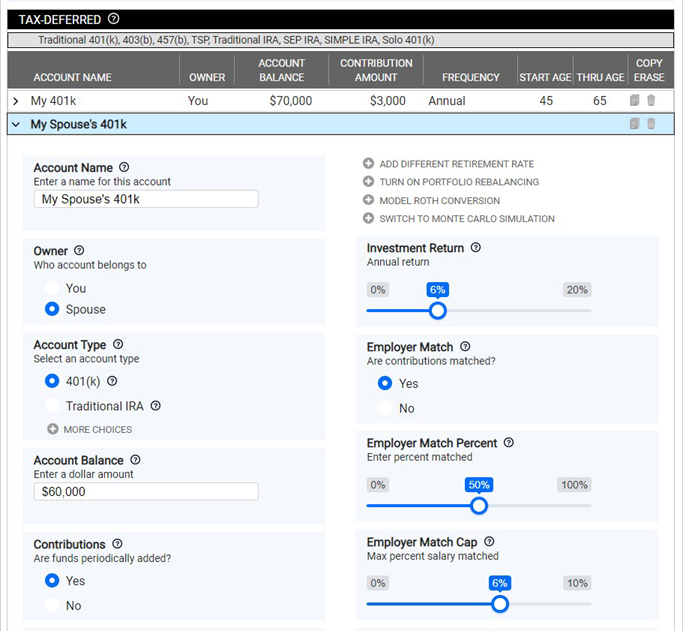

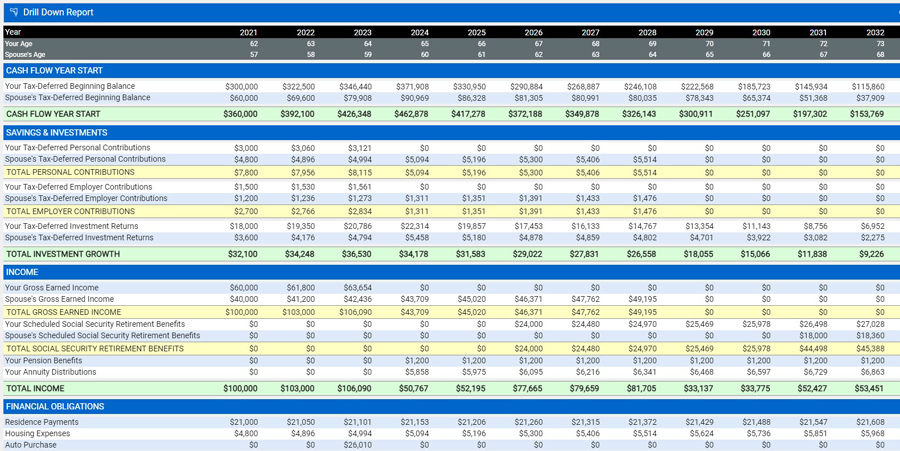

Eggstack is remarkably easy-to-use, yet powerful enough for financial professionals. With minimal information about your investments and spending habits Eggstack generates a digital model of your finances and plots your retirement savings over the course of your entire lifetime.

If you can answer a question, you can use Eggstack. The logical arrangement of pages by subject matter helps guide you through the process. Context-sensitive help is available at every step along the way as well as tutorial videos and a comprehensive user guide.

Eggstack was built from the ground up to protect your privacy. No one can hack your sensitive data because Eggstack doesn't ask for any. Eggstack doesn’t ask for your last name, date of birth, address, phone number, Social Security number, driver's license number, employer, financial institutions, or account numbers. Nothing you enter into Eggstack can be tied to you in any way.

If you need in-depth analysis, Eggstack’s got you covered. Advanced modeling features include Roth conversions, portfolio rebalancing, QLACs, alternate distribution strategies, investment property, business income, pensions, annuities, Social Security insolvency, multiple cases, reverse mortgages, tax increases, life insurance, home purchases, state comparisons and more.

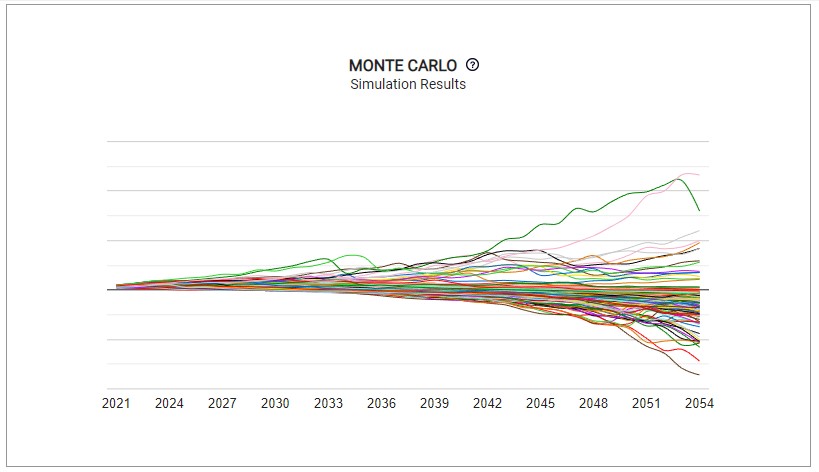

The traditional approach to retirement planning assumes a constant rate of return for your investments and savings. While this method is suitable for most situations, some financial analysts believe it paints an unrealistically rosy picture. Monte Carlo simulation shakes things up by injecting real-world volatility into your retirement plan.

Eggstack supports both traditional calculations and Monte Carlo simulation. When Monte Carlo simulation is enabled, your financial model is stress-tested by subjecting it to extensive iterations of randomly-selected investment returns.

Eggstack is designed for individuals and couples, those who are planning for retirement, and those who are already retired. You can perform what-if scenarios to your heart’s content with Eggstack’s Case Manager and comparison charts.

Eggstack is adaptable to any financial situation and provides answers to your most urgent retirement questions:

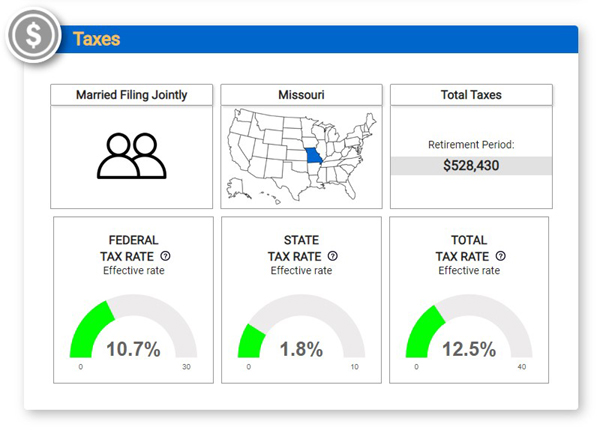

Did you know that the average American pays more in taxes than the cost of food, clothing, entertainment, and healthcare combined? Taxes play a huge role in retirement planning which is why Eggstack doesn't just estimate your taxes, it calculates them.

Eggstack calculates your tax liability for each year based on the latest IRS tax code and the tax laws in your state. Calculating state income taxes allows you to perform meaningful comparisons between retiring in different states.

Eggstack empowers you to make informed decisions both before and after retirement. You get peace of mind knowing how much you need to save, when you can retire, and how much you can spend in retirement. These are important decisions with significant consequences if you miss the mark.

For example, if you save too much for retirement you may regret not doing more when you were younger and your children still lived at home. If you don’t save enough, you may spend your golden years living in squalor.

Retirement is too important for rules of thumb and uncertainty. Eggstack takes the guesswork out of retirement planning. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

No one has a more vested interest in your retirement than you. It’s your retirement and you’re going to be living it, shouldn’t you be the one planning it? Stop losing sleep over your lack of preparation and get started with your free plan today!

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.