Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

Most people know the earlier you begin drawing Social Security retirement benefits the smaller your checks will be. Put another way, the longer you wait to start receiving Social Security benefits the larger your checks will be. The big question is, when should you begin taking Social Security?

Suppose you delay Social Security retirement benefits until the maximum age of 70, but you die on the day before your 70th birthday. Obviously it would have been better if you had taken benefits right from the start at the minimum age of 62. At least that way you would have received something. On the other hand, suppose you live until the ripe old age of 100. In that case you would be better off delaying Social Security until you turn 70.

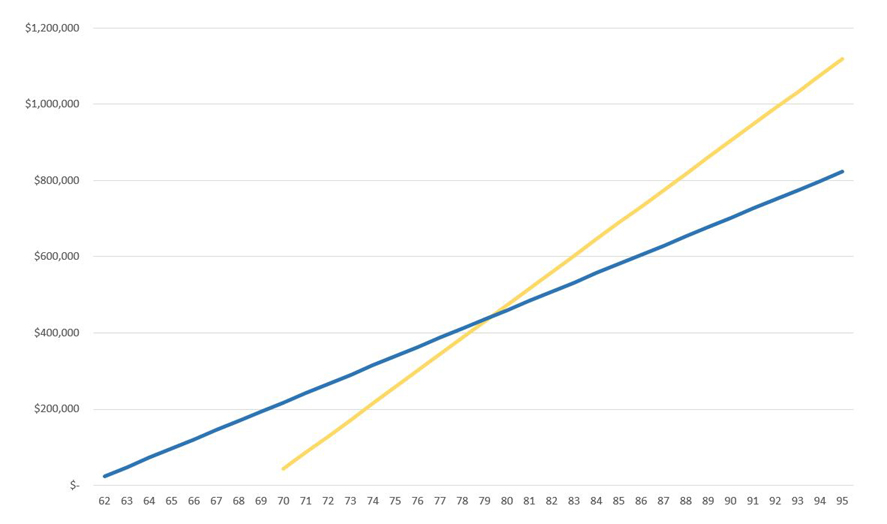

The blue line in the graph below represents receiving Social Security beginning at age 62, and the gold line represents receiving Social Security starting at age 70. The graph is based on realistic middle-class numbers of $2,017 per month for benefits taken at age 62 and $3,587 per month for benefits taken at age 70:

The two lines intersect at age 79, which says that if you live less than 79 years you would be better off taking Social Security beginning at age 62, and if you live past 79 you would be better off delaying benefits until age 70. If you live to age 95, you would come out ahead by approximately $300,000 by delaying benefits until age 70.

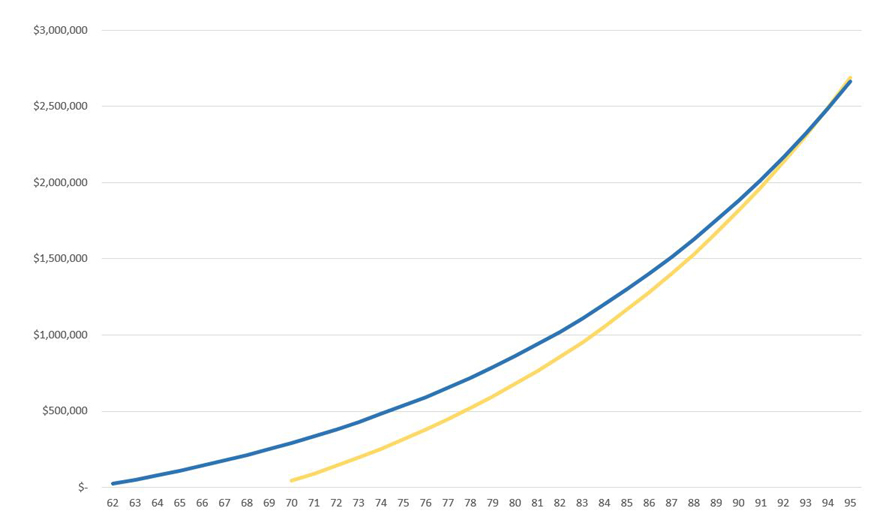

Everything is the same in the graph below except for the addition of a 6% return on investment.

Adding an investment return changes things considerably. This graph says that no matter how long you live, you are better off taking Social Security at the age of 62.

The second graph is interesting but it’s not very realistic. When you retire, you are no longer saving and investing, you are drawing down your accounts to meet your living expenses. Only someone who doesn’t need Social Security would invest their monthly checks.

Up until this point, we’ve been talking in terms of taking Social Security at the extremes – 62 and 70. In reality, you can choose to start anytime between those ages.

Everyone is assigned a full retirement age which for most people is 66 or 67 depending on when you were born. At full retirement age, your monthly retirement benefit is set at a fixed amount. That amount is reduced if you begin drawing benefits before full retirement age and it is increased if you delay benefits beyond full retirement age.

The simplest way to determine your Social Security benefits is to create an account at ssa.gov. There you will find not only your full retirement age but also your benefits at full retirement age, minimum age 62, and maximum age 70.

If you are curious about how those values are determined, or if you just like doing things the hard way, what follows is an explanation of how Social Security retirement benefits are calculated. The penalty for taking benefits prior to full retirement age is calculated as 5/9 of 1% for each month up to 36 months. Beyond that it becomes 5/12 of 1% for each month over 36 months. The credit for delaying the start of benefits until after you reach full retirement age is calculated as 8% per year. In our example above, it works out like this:

Sample Monthly Social Security Retirement Benefits, beginning at Age:

62: $2,017There are many factors to consider in deciding when to begin taking Social Security retirement benefits. One is the solvency of the program itself. According to the annual report from the Social Security Administration’s own Board of Trustees, the fund will run dry in the year 2033. After that it will only pay 77 cents on the dollar for scheduled Social Security retirement benefits.

Hopefully congress will step in and do something before that happens but it remains to be seen. Another consideration is your actual retirement date. If you are drawing Social Security retirement benefits and still working, your benefits may be reduced for as long as you keep working. Another more basic consideration is simply making ends meet. Some people are forced to retire before they reach full retirement age due to failing health or other circumstances beyond their control. If your savings and investments are insufficient to meet your living expenses, you have no choice but to start taking Social Security benefits.

Admittedly, it’s complicated. The best way to plan for retirement is to hire a financial advisor or avail yourself to sophisticated financial modeling software. Financial modeling software performs year-by-year simulation to deliver results tailored to your unique situation. To learn more, check out this article entitled Best Retirement Planning Software. Whatever you do, keep saving and planning for retirement.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future. This article is for informational purposes only and is not financial advice or any other type of advice. Eggstack makes no representation to the validity, accuracy, completeness, or suitability of purpose of any information presented in this article.