Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

Who knew retirement planning was so easy you could do it with a rule of thumb? Join us as we expose the folly of retirement rules of thumb.

The 4 percent rule of thumb says as long as you don’t withdraw more than 4 percent per year from your retirement account, you will never run out of money. In your first year of retirement you withdraw 4% of your retirement savings and use it to cover your living expenses. Every year thereafter you continue to withdraw 4 percent adjusted for inflation.

Let’s look at an example. Let’s say you retire on the day you turn 65 and you have $1,000,000 in retirement savings. Following the 4% rule of thumb, in your first year you withdraw $40,000 (0.04 x $1,000,000). Based on an annual inflation rate of 2 percent, the second year you withdraw $40,800 (1.02 x $40,000). In the third year you withdraw $41,616 (1.02 x $40,800).

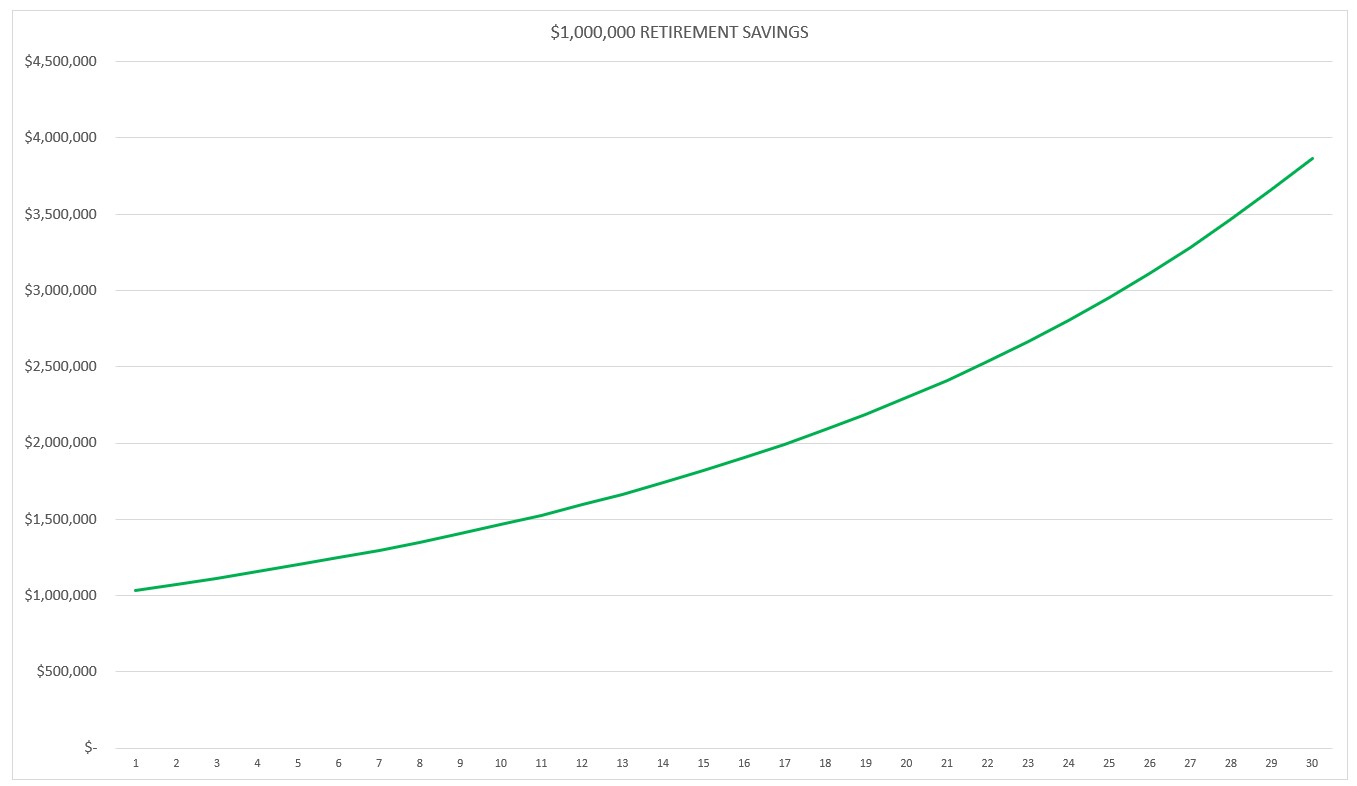

30 years later at the ripe old age of 95 your number is up, you’re headed to the giant rest home in the sky. You make your last withdrawal which at that point is $71,034. Based on a 60:40 split of stocks to bonds with stock returns of 10% and bond returns of 4%, here is a graph of your account over your 30-year retirement period:

As you can see, at the end of 30 years you have almost $4,000,000 in your account. That’s great news for your heirs, not so great for you. You could have lived a much better life – both before and after retirement – had you not followed the 4% rule.

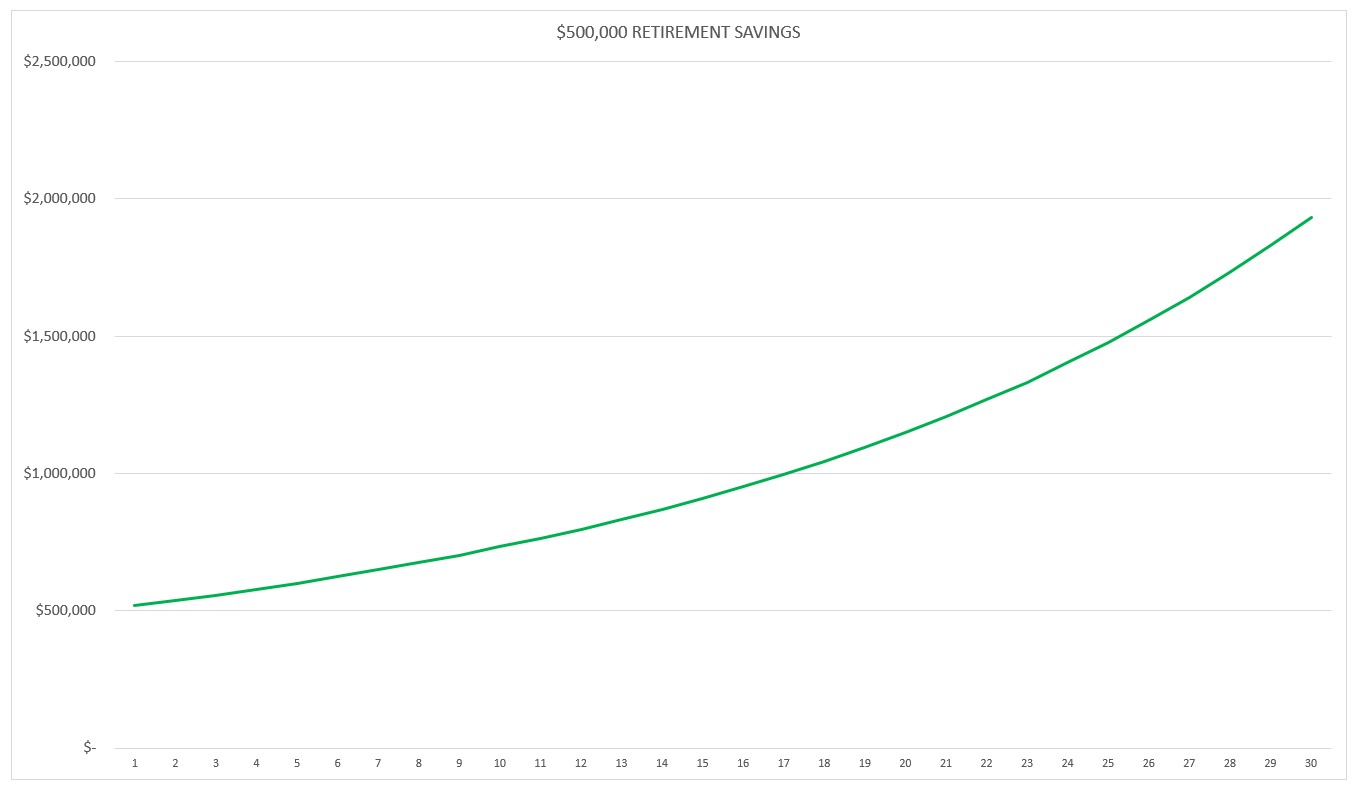

You might say the problem is you didn’t need $1,000,000. Okay, let’s do it again. This time we’ll start with half as much, $500,000. Following the 4% rule, you withdraw $20,000 in your first year of retirement (0.04 x $500,000) and maintain that withdrawal rate, adjusted for inflation, just like before. At the end of 30 years this is what your account looks like:

You have almost $2,000,000. Either way, the 4 percent rule has let you down. These are not ideal outcomes.

Of course you don’t want to run out of money in retirement, but neither do you want to needlessly live like a pauper both before and after retirement only to leave most of your money to your heirs. A much better plan would be to save the right amount and draw it down in retirement at a rate that allows you to enjoy your life.

The 80 20 rule of thumb says you should save enough money to replace 80 percent of your pre-retirement income. If you’ve ever used a free online calculator at your bank’s website or the financial institution that holds your 401(k) plan, this rule of thumb is what you’ve used.

The 80 20 rule of thumb assumes that your home will be paid off by the time you retire and you will be in a lower tax bracket. It also assumes that your everyday spending will decrease on things like the daily commute, going out to lunch, and spending on dry-cleaning and other clothing-related costs. While that may be true, there are other costs that will likely increase in retirement. Retirees often travel more, especially at first. You might find yourself spending more on hobbies to fill your spare time, and obviously your healthcare costs will increase.

The other two assumptions which form the basis of the 80 20 rule are equally questionable. A recent survey found that one-third of Americans age 65 and older still have a home mortgage. What’s more, the average balance is $79,000. Regarding taxes, who’s to say you will be in a lower bracket when you retire? Distributions from traditional 401(k)s, traditional IRAs, pensions, and most annuities are taxed as ordinary income. Even some of your Social Security retirement benefits may be taxable.

The basic theory of the 80 20 rule is that you will carry into retirement the same lifestyle that you enjoyed when you were working. If that is true, doesn’t it stand to reason that you will need the same amount of income? The truth is, your tax rate in retirement may be the same as it was when you were working.

We haven’t even touched on retirement age or life expectancy. The 80 20 rule is based on having enough retirement savings to replace 80 percent of your pre-retirement income. For how long? Wouldn’t that be kind of important? If someone retires at 55 and lives to 95, would they not need four times as much savings as someone who retires at 67 and only lives to age 77? Of course they would. Another swing and a miss for the 80 20 rule.

Retirement rules of thumb are a dumpster fire. The very notion that you should plan something as important as your retirement with an outdated, one-size-fits-all rule of thumb is ridiculous. To do so would be irresponsible.

The best way to plan for retirement is to hire a financial advisor or avail yourself to sophisticated financial modeling software. Rather than relying on outdated retirement rules of thumb, financial modeling software performs year-by-year simulation to deliver results tailored to your unique situation. To learn more, check out this article entitled Best Retirement Planning Software. It’s your retirement and you’re going to be living it, shouldn’t you be planning it?

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.