Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

Americans are enjoying better health and living longer than ever. As a result, many people are working well beyond normal retirement age. One-third of Americans age 65 and older are still employed, and that number is expected to rise. Many of those working past age 65 are collecting Social Security retirement benefits.

Think about one of the first questions we ask when meeting someone new: What do you do? Our vocation is so intertwined with our personal lives that it becomes part of who we are. It should come as no surprise that many people experience a loss of purpose when they retire. For that reason and many others, it has become commonplace for people to continue working past normal retirement age. Many keep working not because they have to, but because they want to.

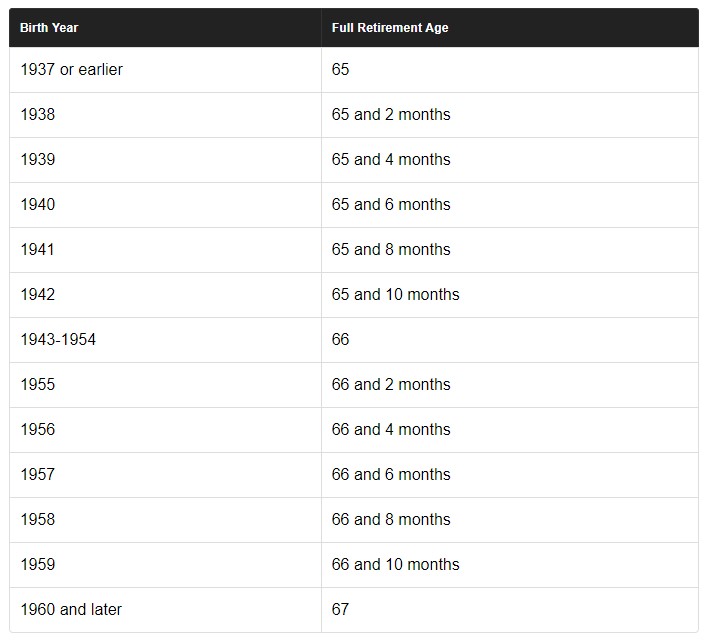

You are not eligible for Social Security retirement benefits until you reach age 62, and your benefits cannot be penalized for earned income once you reach full retirement age. Therefore, only those between age 62 and full retirement age are at risk for having their benefits reduced due to earned income. Full retirement age is defined by the Social Security Administration in the table below:

Some people make this more complicated than it needs to be. I have read countless financial books and articles and consumed hours of related radio and podcast programming. I have come to the conclusion that some are either intentionally trying to confuse us or they are just really bad at explaining things.

For example, in one article the author sets out to explain the matter at hand (i.e., social security benefits and working beyond retirement age) and right in the middle of it he tosses in the fact that since the recipient is less than full retirement age, their benefits will be reduced. Those are two totally separate things! Most people know that the sooner you start taking Social Security the less your monthly checks will be, but that’s a topic for another day! You don’t throw that in right in the middle of explaining earned income benefit reductions.

It’s not that complicated. In fact, the entire matter can be summed up in one sentence.

The Sentence

If you are between age 62 and full retirement age and you are working and drawing Social Security retirement benefits, for as long as you keep working your benefits may be reduced until you reach full retirement age.

If anything in that sentence does not apply to you and it never will, this matter does not concern you. However, if that sentence does apply to your situation or it may at some point in the future, you need to read on.

The Social Security Administration sets a limit on how much you can earn before your retirement benefits are reduced, and the limit changes every year. That is, SSA looks at the current rate of inflation and determines how much to increase the limit each year. For 2025, the annual individual earned income limit is $23,400.

Here’s how it works: For every $2 that you earn over the annual individual earned income limit of $23,400, your Social Security benefits will be reduced by $1. Let’s plug that into the sentence.

The Revised Sentence

If you are between age 62 and full retirement age and you are working and drawing Social Security retirement benefits, for as long as you keep working your benefit will be reduced by $1 for every $2 you earn each year over $23,400 until you reach full retirement age.

The folks at Social Security looked at that and decided it was too easy. It wouldn't confuse enough people so they threw in another wrinkle. In the calendar year in which you reach full retirement age, the benefit reduction changes to $1 for every $3 earned, and the annual individual earned income limit increases to $62,160 (for 2025).

Here’s how it works: For the months in the calendar year leading up to when you reach full retirement age, for every $3 you earn over the annual earned income limit of $62,160, your Social Security benefits will be reduced by $1. Let’s plug that into the sentence.

The Revised Revised Sentence

If you are between age 62 and full retirement age and you are working and drawing Social Security retirement benefits, for as long as you keep working your benefits will be reduced by $1 for every $2 you earn each year over $23,400 until you reach the calendar year in which you turn full retirement age at which point your benefit will be reduced by $1 for every $3 you earn over $62,160.

Now there’s a sentence any attorney would be proud of!

There are two caveats worth mentioning. First, any reduction in benefits only applies to the years you are working. The reduction is not permanent, so if you stop working your benefit returns to normal. Second, this rule only applies to earned income, it does not include income from other sources such as investments, pensions, or Social Security itself.

Ultimately, most people have to stop working at some point due to declining health, caregiving responsibilities, or other reasons. Hopefully your financial circumstances will not require you to work any longer than you want and your health will hold out to allow you to work for as long as you want.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.