Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

We hear a lot these days about the merits of selling your home and renting in retirement. Like so many things in life, timing is everything. Join us as we examine the ideal age for seniors to sell and rent.

Renting rather than owning provides a degree of flexibility that appeals to many seniors. No longer tied to your workplace, you are free to live anywhere you want. Then there's the matter of maintenance and upkeep that comes with owning a home. It becomes increasingly tiresome as we age and for some it can feel overwhelming. Something always needs fixing, and big-ticket items like a new heating and cooling system or new roof really take their toll.

Trapped equity; i.e., being house rich and cash poor, is another consideration. Unless you go down the relatively unpopular road of getting a reverse mortgage, holding onto your home until the bitter end means forgoing a sizeable chunk of cash. Finally, home ownership can complicate estate matters. Your heirs are left with the task of cleaning out your house and getting it ready to sell.

Selling your home in retirement may sound appealing, but nobody said anything about doing it the day you retire. If you're going to do it, you need to time it right. Do it too early and you may go bankrupt paying rent. Do it too late and you may miss out on your last opportunity to enjoy the influx of cash due to age-related health issues.

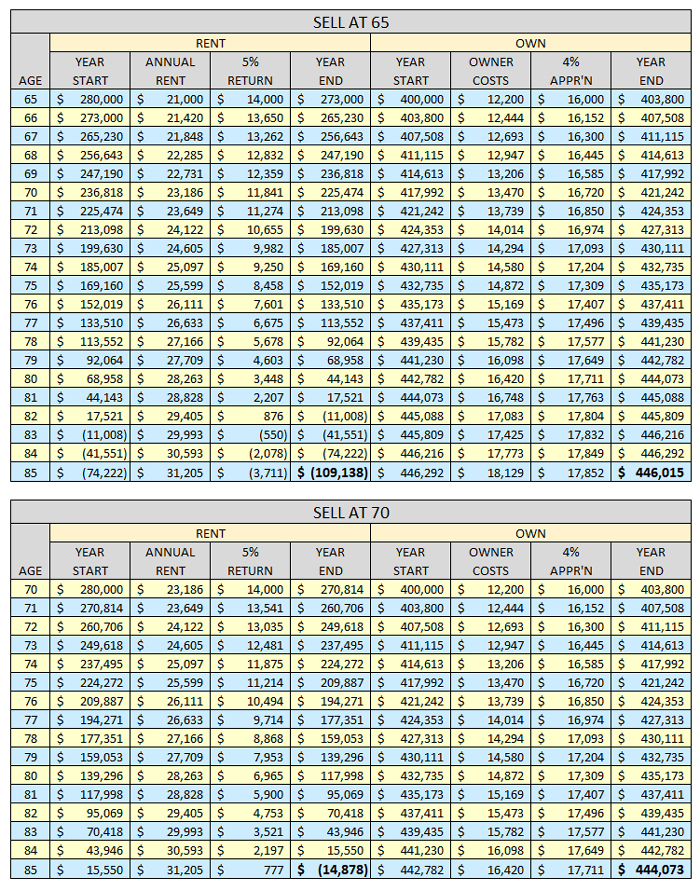

Let's look at an example.* Bob and Mary are each 65 years of age and they have just retired. Clean living and good luck says they will live to see their 85th birthdays. Their house is paid off and valued at $400,000. Each year they pay $6,000 in property taxes, $1,200 in homeowners insurance, and on average $5,000 in maintenance and repairs.

They've looked around at all types of rentals including houses and condominiums, 55-and-up adult communities, and luxury apartments. They don't need anything as large as their current home but they've grown accustomed to a certain amount of space and they want to be comfortable when family comes to visit. Based on what they have seen, they are looking at a monthly rent of about $1,750.

Bob and Mary take the plunge and sell their home. 30 Percent of the proceeds go to income taxes, real estate commissions, and seller's closing costs. That leaves them with $280,000 which they place in a modest investment that yields a 5% return. $1,750 in monthly rent comes to $21,000 per year which increases with inflation at an annual rate of 2%.

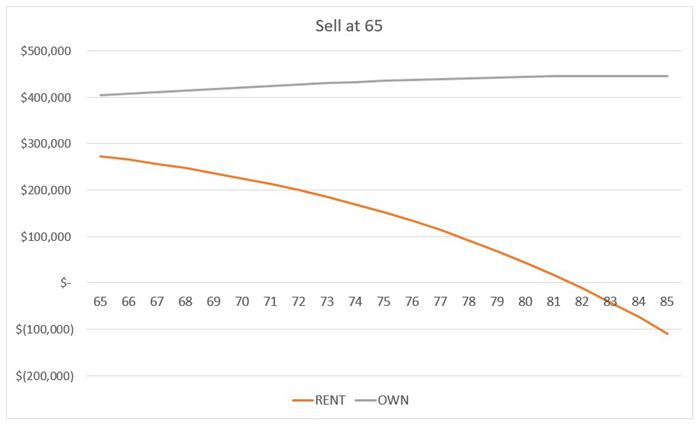

The chart below reflects the financial impact of Bob and Mary's decision. The gray line at the top represents their home's value less ownership costs had they kept it, and the orange line reflects the proceeds from selling their home used to pay rent. As you can see, when they reach 85 years of age, they are $110,000 in the hole. Had they kept their home, they would have come out ahead $445,000.

Contrary to what some would have you believe, owning a home in retirement is not "throwing your 401(k) down the drain". As your home appreciates in value, the appreciation offsets the cost of ownership; i.e., property taxes, insurance, and upkeep. In fact, if you look at the chart you can see appreciation slightly outpaces cost of ownership resulting in a $45,000 increase over the course of Bob and Mary's retirement.

Still there is the argument for selling your home and tapping its financial resources. It goes like this: other than leaving it to your heirs, what good is a half million dollars in home equity when you're gone?

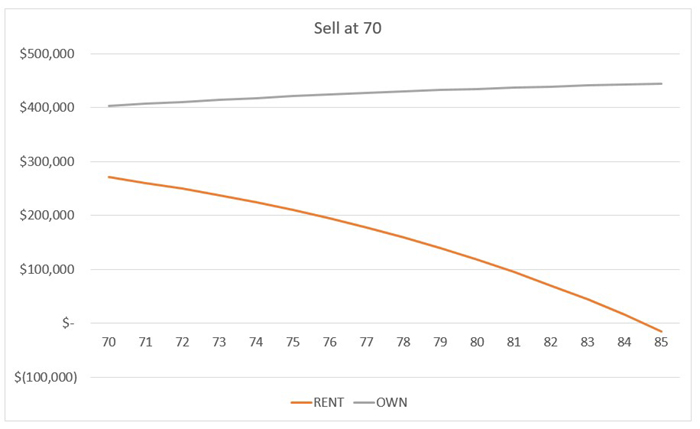

It turns out that if Bob and Mary had waited just 5 years, selling their home and renting would have made more sense. In other words, if you time it right, you can liquidate the assets in your home and use them to pay rent for the rest of your life. That frees up your other retirement savings to travel and have fun. The downside is that if you live too long, you will go broke. Also, your heirs will inherit bupkis.

This chart shows the result had Bob and Mary waited until 70 to sell and rent:

When it comes to retirement planning, every situation is unique and there are no one-size-fits-all solutions. That is why it is so important to seek the assistance of a financial advisor or avail yourself to sophisticated retirement planning software that can evaluate your unique situation.

Just as in science every action has an equal and opposite reaction, in life every decision has consequences. There are few decisions with more far-reaching consequences than those related to retirement planning. You can go out living the life of Riley, or you can suffer through decades of squalor, the choice is yours.

For those interested (and not reading this on your phone) here is the spreadsheet used to generate the charts:

*This is a fictitious example and should not be considered a comprehensive analysis or guidance for your particular situation. Many other factors impact financial outcomes including longevity, market fluctuations, required minimum distributions, and taxes. If you need guidance, please seek the advice of a licensed professional.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.