Mike Ballew – Financial Planning Association member, engineer, author, and founder at Eggstack.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

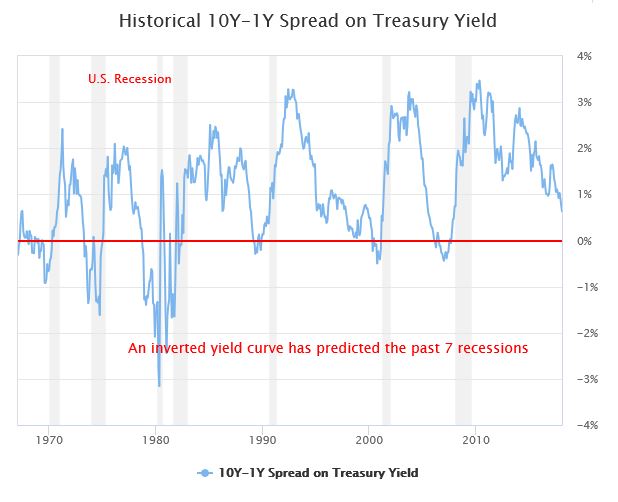

The bond market has accurately predicted every one of the last seven recessions. That’s a pretty good track record. You don’t have to be a bond whisperer to pick up what the bond market is throwing down. Let's listen in on what the bond market has to say.

In bond vernacular, a yield curve is a graphical representation of the return from bonds of identical quality with different maturity dates. The most commonly-referenced yield curve is that of U.S. Treasury bonds.

Long-term bonds in a healthy economy have higher yields than short-term bonds. In an unhealthy economy, long-term bonds have a lower yield than short-term bonds. This is due to the fact that financial experts and investors believe an economic downturn is coming.

The point at which long-term bond yields change from being higher than short-term bonds to lower than short-term bonds is known as an inversion. The result is an inverted yield curve.

When investors see a familiar pattern forming, they react in lockstep like lobotomized lemmings.

An inverted yield curve is a reliable predictor of bad things to come. As mentioned, when it comes to predicting recessions dating all the way back to the 70s, the bond market is seven for seven.

When the yield curve remains inverted for at least three months, the course is set. A recession will take place in the next 8 to 18 months. An inverted yield curve is a giant red flag and it has been waving for most of the last quarter.

One of the interesting things about the stock market is its propensity for self-fulfilling prophecies. When investors see a familiar pattern forming, they react in lockstep like lobotomized lemmings. This dynamic prevents us from knowing if a cycle would have repeated itself organically.

Individual investors do not move markets, institutional investors do. The average individual investor could sell all of their stocks tomorrow and it would have no effect on the overall market. By contrast, when investing behemoths like Geico and Goldman Sachs and Allstate start selling, look out below.

Institutional investors have trillions of dollars tied up in the markets and it takes time to unwind such large positions. Every time there’s an uptick in the market, their computers sell another 100,000-share block. Individual investors can’t win in that environment.

What is the bond market telling us about the U.S. economy? That it’s headed for a fall. And isn’t it about time? We have been in this bull market for 10 years. Everyone knows these things run in cycles. The market goes up, up, up…until it doesn’t.

Investing is like playing musical chairs. It’s all fun and games when the music is playing, but when the music stops you don’t want to be the last left standing.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.