Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

![]() Nobody said getting older was going to be easy. When you reach 72 years of age, you have to begin taking minimum distributions from your retirement accounts each year.

Nobody said getting older was going to be easy. When you reach 72 years of age, you have to begin taking minimum distributions from your retirement accounts each year.

![]() Says who? Maybe I don’t want to.

Says who? Maybe I don’t want to.

![]() The IRS wants their money. Remember when you were saving for retirement? It was done on a pre-tax basis. Your whole life you never paid any taxes on the money you put into your 401(k) or any other pre-tax account such as a 403(b), TSP, or traditional IRA. You owe taxes on that money. When you reach 72 years of age, the IRS is done waiting. They want their money.

The IRS wants their money. Remember when you were saving for retirement? It was done on a pre-tax basis. Your whole life you never paid any taxes on the money you put into your 401(k) or any other pre-tax account such as a 403(b), TSP, or traditional IRA. You owe taxes on that money. When you reach 72 years of age, the IRS is done waiting. They want their money.

![]() After you turn 72 years of age, you are required to withdraw a minimum amount from your pre-tax retirement accounts each year and pay income tax on the withdrawals. Roth retirement accounts such as Roth IRAs do not have this requirement.

After you turn 72 years of age, you are required to withdraw a minimum amount from your pre-tax retirement accounts each year and pay income tax on the withdrawals. Roth retirement accounts such as Roth IRAs do not have this requirement.

![]() That's it, I’m changing all my accounts to Roth IRAs. What is it, like a checkbox or something?

That's it, I’m changing all my accounts to Roth IRAs. What is it, like a checkbox or something?

![]() No, it doesn’t work that way. No taxes are owed on Roth accounts because they are funded with after-tax dollars. In other words, you already paid taxes on the money placed into a Roth account. On the other hand, taxes come due on pre-tax accounts when you start withdrawing money in retirement. Required minimum distributions are the government’s way of making you take money out of your accounts.

No, it doesn’t work that way. No taxes are owed on Roth accounts because they are funded with after-tax dollars. In other words, you already paid taxes on the money placed into a Roth account. On the other hand, taxes come due on pre-tax accounts when you start withdrawing money in retirement. Required minimum distributions are the government’s way of making you take money out of your accounts.

If you don't take the required minimum distributions or you take less than required, you will be charged a 50 percent penalty on your federal income taxes. The penalty is based on the difference between the amount you withdrew and the amount you should have withdrawn. And, you will still have to withdraw the required amount and pay income taxes on it.

![]() What is this, Russia?

What is this, Russia?

![]() As usual, if you don’t play by the rules, the IRS will get you. Getting older is not for the faint of heart.

As usual, if you don’t play by the rules, the IRS will get you. Getting older is not for the faint of heart.

![]() Who you calling faint of heart? Get over here and I’ll show you faint of heart. They don’t call me Tommy Two Toes for nothing.

Who you calling faint of heart? Get over here and I’ll show you faint of heart. They don’t call me Tommy Two Toes for nothing.

![]() Tommy Two Toes? Why do they call you that, if I may ask?

Tommy Two Toes? Why do they call you that, if I may ask?

![]() Cuz that’s how many toes you got left when I get through with you.

Cuz that’s how many toes you got left when I get through with you.

![]() Uh, let's move on. What you do with the required minimum distribution is up to you. You can spend it or you can reinvest it in a taxable account. In either case, you have to pay income taxes on the amount withdrawn. Don’t tell anyone, but there is a way to get around this.

Uh, let's move on. What you do with the required minimum distribution is up to you. You can spend it or you can reinvest it in a taxable account. In either case, you have to pay income taxes on the amount withdrawn. Don’t tell anyone, but there is a way to get around this.

![]() Alright, now we’re talking!

Alright, now we’re talking!

![]() We will look at both the taxable and tax-free alternatives in more detail, but first let’s examine how required minimum distributions are calculated.

We will look at both the taxable and tax-free alternatives in more detail, but first let’s examine how required minimum distributions are calculated.

![]() Work, work, work. You bean-heads are all the same.

Work, work, work. You bean-heads are all the same.

![]() There’s really not much to it and it would be rare that you had to calculate it for yourself. When you reach required minimum distribution age, most financial institutions do it for you.

There’s really not much to it and it would be rare that you had to calculate it for yourself. When you reach required minimum distribution age, most financial institutions do it for you.

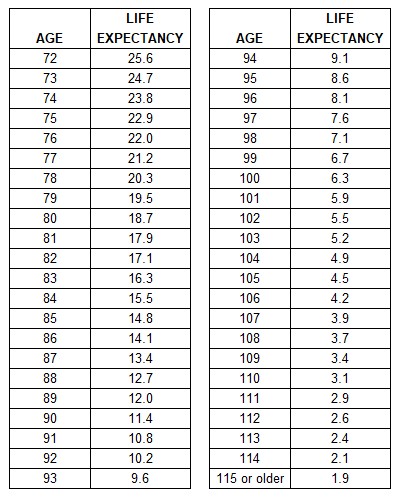

To calculate your required minimum distribution, find your age on this table from IRS Publication 590-B and locate your corresponding life expectancy. Divide your retirement account balance as of December 31 of the prior year by your life expectancy. The result is that year’s required minimum distribution. The same calculation is applied every year to each of your pre-tax accounts.

![]() Let’s look at an example. Suppose you are 80 years old and you have a traditional IRA that was worth $100,000 at the end of last year. The corresponding life expectancy from the table is 18.7 years, so the calculation would be $100,000 divided by 18.7 which equals $5,348. So for that year you would have to withdraw at least $5,348 from your IRA.

Let’s look at an example. Suppose you are 80 years old and you have a traditional IRA that was worth $100,000 at the end of last year. The corresponding life expectancy from the table is 18.7 years, so the calculation would be $100,000 divided by 18.7 which equals $5,348. So for that year you would have to withdraw at least $5,348 from your IRA.

![]() You think you’re so smart don’t you? Anybody can do that.

You think you’re so smart don’t you? Anybody can do that.

![]() As mentioned, when it comes to how to deal with required minimum distributions, you have both taxable and tax-free alternatives. Obviously if you spend the money it will be taxed as ordinary income. The other taxable alternative is to place the required minimum distribution into a taxable account.

As mentioned, when it comes to how to deal with required minimum distributions, you have both taxable and tax-free alternatives. Obviously if you spend the money it will be taxed as ordinary income. The other taxable alternative is to place the required minimum distribution into a taxable account.

![]() What’s a taxable account?

What’s a taxable account?

![]() A taxable account is any savings or investment vehicle in which investment returns are taxed. For example, an interest-bearing bank savings account, money market fund, certificate of deposit (CD), or a cash account with an online broker.

A taxable account is any savings or investment vehicle in which investment returns are taxed. For example, an interest-bearing bank savings account, money market fund, certificate of deposit (CD), or a cash account with an online broker.

![]() Now we get to the good part, how to maintain the tax-free status of your required minimum distribution.

Now we get to the good part, how to maintain the tax-free status of your required minimum distribution.

![]() About time.

About time.

![]() There are two ways to keep from paying taxes on required minimum distributions. The first is to donate the required minimum distribution to a qualified charity. The IRS places a limit on this option. The maximum amount that can be donated to charity is $111,000.

There are two ways to keep from paying taxes on required minimum distributions. The first is to donate the required minimum distribution to a qualified charity. The IRS places a limit on this option. The maximum amount that can be donated to charity is $111,000.

![]() Hold up a second bean-boy. That’s your big solution? I’m supposed to give my money away? What else you got?

Hold up a second bean-boy. That’s your big solution? I’m supposed to give my money away? What else you got?

![]() The other tax-free alternative is to roll your pre-tax account into a qualified longevity annuity contract, also known as a QLAC. Again, the IRS sets a cap on the amount that can be put into a QLAC. The limit is $210,000 or 25 percent of your account value, whichever is less.

The other tax-free alternative is to roll your pre-tax account into a qualified longevity annuity contract, also known as a QLAC. Again, the IRS sets a cap on the amount that can be put into a QLAC. The limit is $210,000 or 25 percent of your account value, whichever is less.

![]() Wait a minute. You said my required distribution is gonna be like five thousand dollars or whatever. Why am I putting all my money into some annuity I never heard of? What are you trying to pull here bean-boy?

Wait a minute. You said my required distribution is gonna be like five thousand dollars or whatever. Why am I putting all my money into some annuity I never heard of? What are you trying to pull here bean-boy?

![]() I am not trying to pull anything. And stop calling me bean-boy.

I am not trying to pull anything. And stop calling me bean-boy.

![]() Yeah? Who’s gonna make me?

Yeah? Who’s gonna make me?

![]() Can you just please stop interrupting? I’d like to get through this.

Can you just please stop interrupting? I’d like to get through this.

![]() Yeah. Fine. Whatever.

Yeah. Fine. Whatever.

![]() A QLAC is a special type of deferred annuity that begins paying out a steady monthly income at a predetermined start age but not later than your 85th birthday. The start age and monthly amount are set when the annuity contract is purchased. A QLAC is established by transferring money from a qualified pre-tax account into the annuity.

A QLAC is a special type of deferred annuity that begins paying out a steady monthly income at a predetermined start age but not later than your 85th birthday. The start age and monthly amount are set when the annuity contract is purchased. A QLAC is established by transferring money from a qualified pre-tax account into the annuity.

On the pro side, a QLAC delays required minimum distributions until the start age, which is the primary objective. It also provides you with peace of mind knowing that when you get advanced in years, you will be taken care of. When you’re older you may not be able to manage your portfolio or you may be tired of dealing with it. With a QLAC, you have someone to do that for you.

The main con with a QLAC is that you may not live until the pre-determined start age.

![]() Is that it?

Is that it?

![]() Yes, I believe that concludes our presentation. Thanks for coming.

Yes, I believe that concludes our presentation. Thanks for coming.

![]() Don’t mention it. Bean-boy.

Don’t mention it. Bean-boy.