Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

This is the conclusion of our special two-part series on dealing with unplanned expenses. In Part I we outlined the first two steps in turning unplanned expenses into planned expenses. Let's look at the third and final step.

Sample Expenses

The final step in turning unplanned expenses into planned expenses is to convert the estimated amounts into monthly values. We will start with the easy ones. Annual amounts are converted into monthly values by dividing by 12:

Neighborhood association dues: $400 per year divided by 12 equals $33 per month.

Vacation: $5,000 per year divided by 12 equals $417 per month.

Christmas gifts: $750 per year divided by 12 equals $63 per month.

The other expenses are not so simple. They require you to estimate how often the expense occurs and the number of years until the expense comes due. This time we’ll start with the hardest one so the others will seem easy.

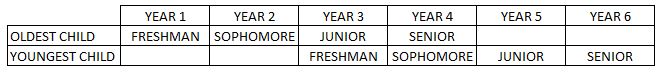

Suppose you have two children that you plan to send to college, one is 4 years old and the other is 6. Assuming they will each start college at the age of 18, your youngest will start in 14 years and your oldest will begin in 12 years. Since you are basing your plan on the assumption that they will each attend college for 4 years, this expense takes place over a period of 6 years:

We could get fancy and perform a simulation to determine the exact point in time over the 6-year period that the expense must be fully-funded in order to prevent the fund from running dry, but we said we are going to keep things simple. Let’s assume that as long as the expense is fully-funded by the beginning of the youngest child’s freshman year, it will never run out of money. We said the youngest child will begin college in 14 years, so that’s the figure we’ll use. Once that has been established, the rest is math: 14 years is 168 months, $160,000 divided by 168 months equals $952. If you want to put these two children through college, you will need to begin saving $952 per month.

Home roofs and heating/cooling systems have similar lifespans, typically 15 years. We’ll do one and it will work for the other since each was estimated to be $7,500. Let’s assume your house is 5 years old. That means in 10 years you are going to need to replace the roof. 10 years is 120 months. $7,500 divided by 120 months equals $63. You will need to start saving $63 per month in order to replace the roof in 10 years, and another $63 in order to replace the heating/cooling system.

Let’s say you anticipate wedding expenses for your youngest and as we’ve said she is 4 years old. The average age for marriage in the U.S. is 27. That means the expense will occur in 23 years, or 276 months. $35,000 divided by 276 months is $127. So in order to pay for your youngest child's wedding in 23 years, you will need to start saving $127 per month.

Finally, your vehicle’s tire replacement. Let’s assume your tires need replacing every 40,000 miles, and that you’ve already put 10,000 miles on them. Let’s say you drive 1,500 miles per month. The 40,000-mile tire rating minus 10,000 miles already driven equals 30,000 miles. 30,000 miles divided by 1,500 miles per month equals 20 months. $500 divided by 20 months equals $25. Based on these assumptions, you will need to save $25 per month in order to have $500 in 20 months needed to replace your tires.

Based on these sample values, which again would need to be replaced with your own, you would need to add a total of $1,743 to your monthly budget to cover these expenses. Based on the fact that over half of Americans can’t cover an unexpected expense of $500, it’s safe to say only a fraction of people do this kind of planning. Which means that when one of these expenses occurs, most people will be reaching for a credit card – or phoning a friend. You don’t have to be one of them.

Just a word about the mechanics of saving before we wrap things up. For smaller items and items that come due in a year or less, you can save for them in your bank. By putting your savings in the bank you will not earn any appreciable interest, but it’s convenient and the funds will be readily available when you need them.

For larger items that don’t come due for many years, you could place them in some type of investment that yields a return. That way you have a hedge against inflation. However, the investment needs to be reasonably liquid so the funds will be available when you need them. In our example, these items would include college savings, wedding savings, and savings for the replacement of the roof and heating/cooling system.

There are no unplanned expenses, only unprepared people. Use this as a guide to develop your own plan for these kinds of expenses and start saving.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.