Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

We invite you to join us as we explain Medicare in plain, simple English. No detours for special cases, no seldom-used exceptions. This is Medicare explained.

You qualify for Medicare if you are 65 years of age or older and you have been a U.S. citizen or permanent legal resident for at least 5 consecutive years and you or your spouse has worked and paid Medicare taxes for at least 10 years.

Medicare part A covers hospitalization. It includes in-patient care in a regular hospital, psychiatric hospital, skilled nursing facility, hospice, or in-home care for the homebound. If you qualify for Medicare, you receive Medicare Part A free of charge.

Medicare Part B provides outpatient medical coverage. This includes medical equipment, visits to your doctor, and ambulance services. The premiums are $185 per month. If your annual income exceeds $106,000 ($212,000 for couples), you will have to pay more for Medicare Part B.

Medicare Part D is drug coverage. This includes prescription medications and vaccines. Medicare Part D costs $48 per month.

Medicare Parts A, B, and D are health insurance for retirees. Unfortunately, they don’t cover everything. There are limitations, exclusions, deductibles, and co-pays. The potential exists for significant out-of-pocket expenses.

You need insurance to limit your exposure to Medicare out-of-pocket expenses. There are two forms of this type of insurance, both offered by private insurance companies. One is called Medicare Part C and the other Medicare Supplemental Insurance. You can’t get Medicare Part C and Medicare Supplemental Insurance at the same time, you can only have one or the other.

Medicare Part C essentially replaces Medicare parts A and B. Besides having less in terms of limitations, exclusions, deductibles, and co-pays, Medicare Part C provides you with vision and dental coverage; Medicare parts A and B do not. When you have Medicare Part C, you still have to pay the Medicare Part B premium. Medicare Part C costs vary but typically is about $200 per month.

Medicare Supplemental Insurance reduces your out-of-pocket expenses. Just like Medicare Part C, you must have Medicare Parts A and B in order to get Medicare Supplemental Insurance, and you still have to pay for Medicare Part B.

There are 10 Medigap plans with different costs and varying degrees of coverage. Please note that Medigap plans A, B, and D are not Medicare Supplemental Insurance for Medicare parts A, B, and D.

Medigap plans:

The medicare.gov site maintains an updated table that indicates what each Medigap plan covers. Medigap Plan G, which costs about $300 per month, is the most popular.

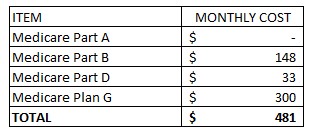

The table below indicates anticipated costs for one retiree on Medicare:

You could trim a hundred dollars by swapping Medicare Part C for Medigap Plan G. That would get you down to $380, but this is just for one person. Couples will pay anywhere between $760 to $960 per month.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.