Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

One of the most common search terms for any celebrity is their net worth. Try it sometime, start typing a celebrity’s name and one of the suggested completions will be net worth. People are curious to see what celebrities are worth. Do you know what your net worth is? Do you know how to calculate it? We invite you to join us as we review how to calculate net worth.

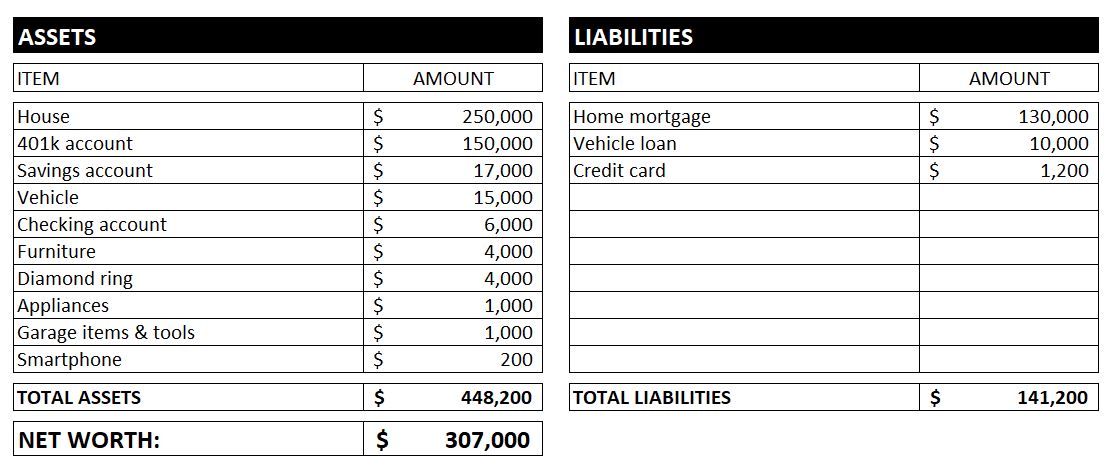

If you would like to calculate your net worth, take out a sheet of paper and draw a vertical line down the middle to separate it into two columns. Label the first column Assets and the other column Liabilities. Make a list of everything of value that you own under Assets, and the outstanding balance of any loans you may have under Liabilities. Subtract the total liabilities from the total assets and that is your net worth.

It’s important to distinguish between assets and income, as well as liabilities and loan payments. Let’s take assets and income first. An asset in terms of net worth is the total value of something. For example, your house might be worth $250,000. If you don’t know the value of your home, you can find it on Zillow. An example of income would be your take-home pay. While it may be true that the sum of your future income is probably your biggest asset (unless you are retired), it doesn’t come into play when calculating net worth.

Similarly, we don’t want to confuse loan payments with liabilities. A liability is the total amount owed on a loan or other financial obligation. A loan payment is the bill you pay each month on that liability.

Let’s look at an example. Here is a sample net worth calculation. This particular example was created in Excel.

Don’t be discouraged if your net worth is negative, it doesn’t mean you’re worthless! It’s very common for young people to have a negative net worth, meaning they owe more than they own. As we age, people tend to pay off student loans and mortgages and other debts, while at the same time contribute to retirement accounts. Eventually the scale tips and you own more than you owe. The example shown here might be for someone in their forties or fifties. Obviously, it’s different for everyone.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.