Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

A recent survey found that 20 percent of Americans have more credit card debt than savings. How sad is that? Creating a budget and sticking to it can help prevent that sort of thing from happening. We invite you to join us as we review how to create a budget.

A budget is an estimate of income and expenditures over a given period of time. Household budgets are typically based on a month. Household budget income consists of take-home pay which is the amount left over after your employer subtracts income taxes, Social Security, Medicare, insurance, retirement plan contributions, and any other withholdings you may have. If you have a spouse or partner who works outside the home, your budget should include both incomes. Expenditures are household living expenses such as rent or mortgage payments, groceries, utility bills, and other financial obligations you have.

If you spend some time researching this subject, you will come across sample budgets with individual lines for things like vitamins and diapers. A household budget should not be that detailed. A budget to that level of detail is too tedious and will never be used. Items such as vitamins and diapers belong in groceries. Whether you create your budget with a pencil and paper or a program such as Word or Excel, it should not exceed one page.

Creating a budget involves some math, which may be the reason so many people don't have one. In order for a budget to work, all income and expenses must be converted to the same time period. It’s really not that hard. Here is a list of how to convert different timeframes to a monthly basis:

DAILY (every day): To convert daily income or expenses to monthly, multiply by 30.42. Example: Spending $5 every day at Starbucks equals $152.10 per month ($5 x 30.42 = $152.10).

WEEKLY (every week): To convert weekly income or expenses to monthly, multiply by 4.35. Example: Spending $120 per week at the grocery store equals $522 per month ($120 x 4.35 = $522).

BIWEEKLY (every two weeks): To convert biweekly income or expenses to monthly, multiply by 2.17. Example: A $3,000 paycheck every two weeks equals $6,510 per month ($3,000 x 2.17 = $6,510).

SEMIMONTHLY (twice a month): To convert semimonthly income or expenses to monthly, multiply by 2. Example: A $1,200 paycheck twice a month equals $2,400 per month ($1,200 x 2 = $2,400).

MONTHLY (once a month): Monthly income and expenses do not need any conversion, they are already on a monthly basis.

SEMIANNUALLY (every six months): To convert semiannual income or expenses to monthly, divide by 6. Example: A $750 car insurance bill paid semiannually equals $125 per month ($750 / 6 = $125).

ANNUALLY (once a year): To convert annual income or expenses to monthly, divide by 12. Example: A $450 homeowners association bill paid once a year equals $37.50 per month ($450 / 12 = $37.50).

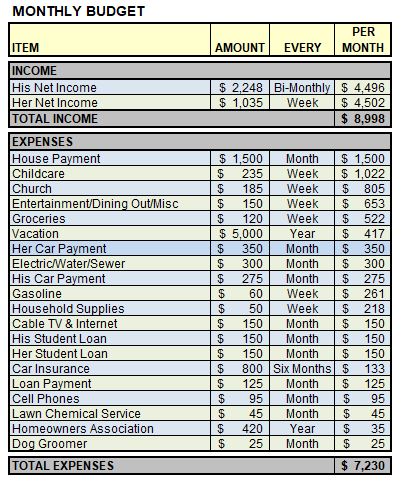

Creating a budget is easy to do and anyone can do it. Make a list of income and expenses and convert them to a monthly basis. Next, add them up as shown in the example below. The sample budget was created using Excel. The nice part about using a spreadsheet is it does the math for you. Plus, you can easily sort your living expenses in descending order.

Note that in the sample above, expenses are less than income. That’s how it’s supposed to be. One of the fundamental reasons to create a budget is to demonstrate you are living within your means. If your monthly expenses exceed your income, you need to make some changes. You cannot spend more than you make, that's tantamount to financial suicide.

The second thing to note is the amount by which the income exceeds the expenses. Living expenses are approximately 80 percent of net income. The other 20 percent goes toward little things not listed in the budget and general savings.

Did you notice in our example there is no line item for credit cards? The right way to use credit cards is to pay them off every month. That way you never pay any interest. Proper use of credit cards helps maintain a healthy credit rating, plus they're always there if you need them. They are more convenient than cash and the rewards are an added bonus.

In our article There are No Unplanned Expenses, we talk about saving for non-monthly obligations and unplanned expenses. Those are things that occur infrequently such as replacing the tires on your car or replacing your home’s heating and cooling system. When you sit down and do the math, you will find that a significant portion of your budget needs to go to these expenses.

It's simple. Create a budget, adjust your lifestyle to meet it, and set some savings aside each month. It's called living right.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future. This article is for informational purposes only and is not financial advice or any other type of advice. Eggstack makes no representation to the validity, accuracy, completeness, or suitability of purpose of any information presented in this article.