Mike Ballew – Engineer, author, and Eggstack founder.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

Perhaps you have heard of the rule of four or 4% rule of thumb for retirement withdrawals. It’s a theory that says as long as you don’t withdraw more than 4% per year from your retirement savings, you will never run out of money. The rule of four was put forward in 1994 by financial advisor William Bengen. The rule assumes that your retirement portfolio consists of 60% stocks and 40% bonds.

According to the rule of four, in your first year of retirement you are supposed to withdraw a lump sum equal to 4% of your total retirement savings. Every year thereafter you are to withdraw the same amount, adjusted for inflation. For example, let’s say on the day you retire you have $1,000,000 in your 401(k) plan. The first year you would withdraw $40,000 (0.04 x $1,000,000). Based on an inflation rate of 2%, the second year you would withdraw $40,800 (1.02 x $40,000). The third year you would withdraw $41,616 (1.02 x $40,800), and so on.

You might ask how we arrived at the one million dollar figure. Good question. Presumably you would work backwards through the numbers to calculate the amount needed to support your lifestyle.

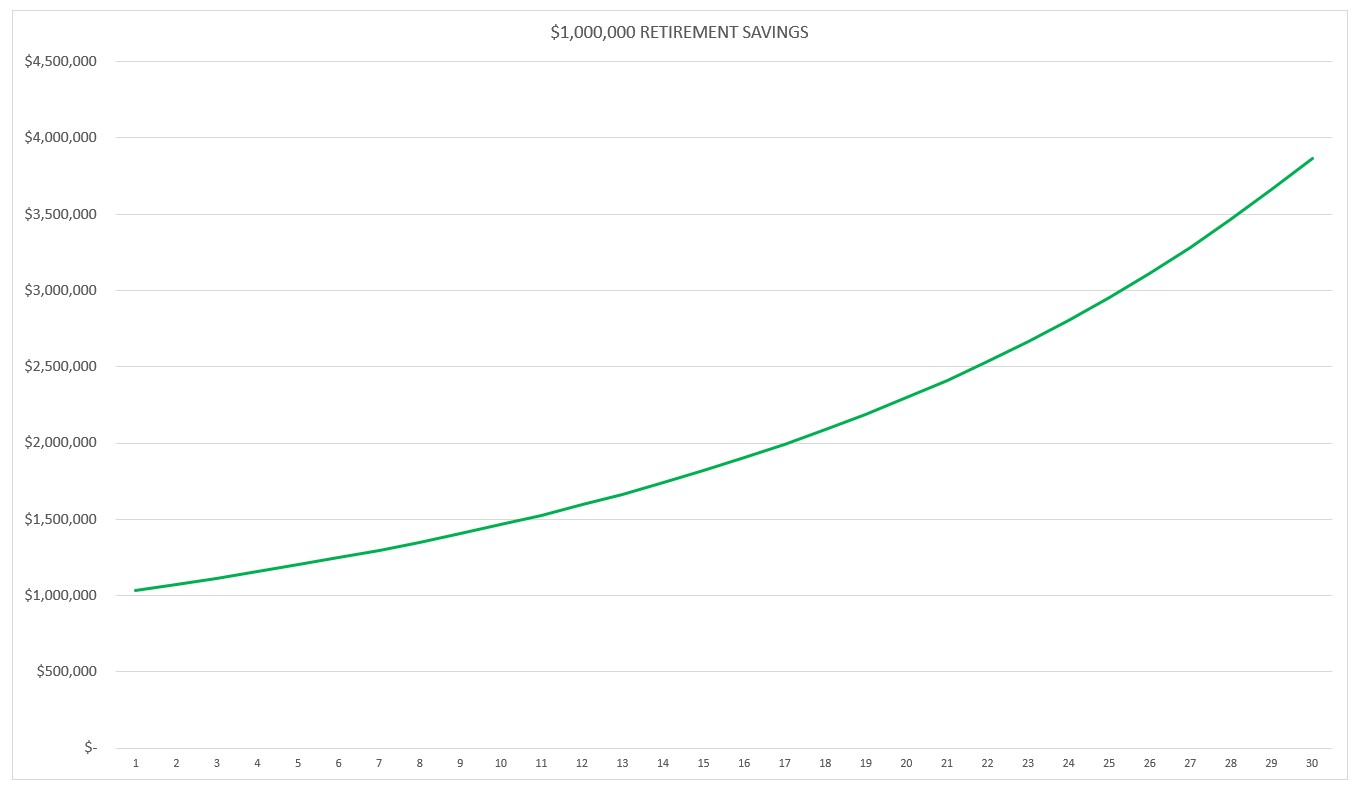

Mr. Bozo scrimped and saved all his life to accumulate $1,000,000 in retirement savings. Mr. Bozo retires at the age of 65 and uses the 4% rule of thumb to determine his first-year withdrawal of $40,000. He makes the same inflation-adjusted withdrawal each year based on 2% inflation for the rest of his life. 30 years later at the age of 95, he makes his final withdrawal which at that point is $71,034. Based on a 60:40 ratio of stocks to bonds, 10% return on stocks, 4% return on bonds, here is the graph of Mr. Bozo’s account over his 30-year retirement period:

As you can see, at the end of Mr. Bozo’s life he has almost $4,000,000 in retirement savings. Great news for Mr. Bozo’s heirs, not so great for Mr. Bozo. Mr. Bozo could have lived a much better life had he not followed the 4% rule of thumb.

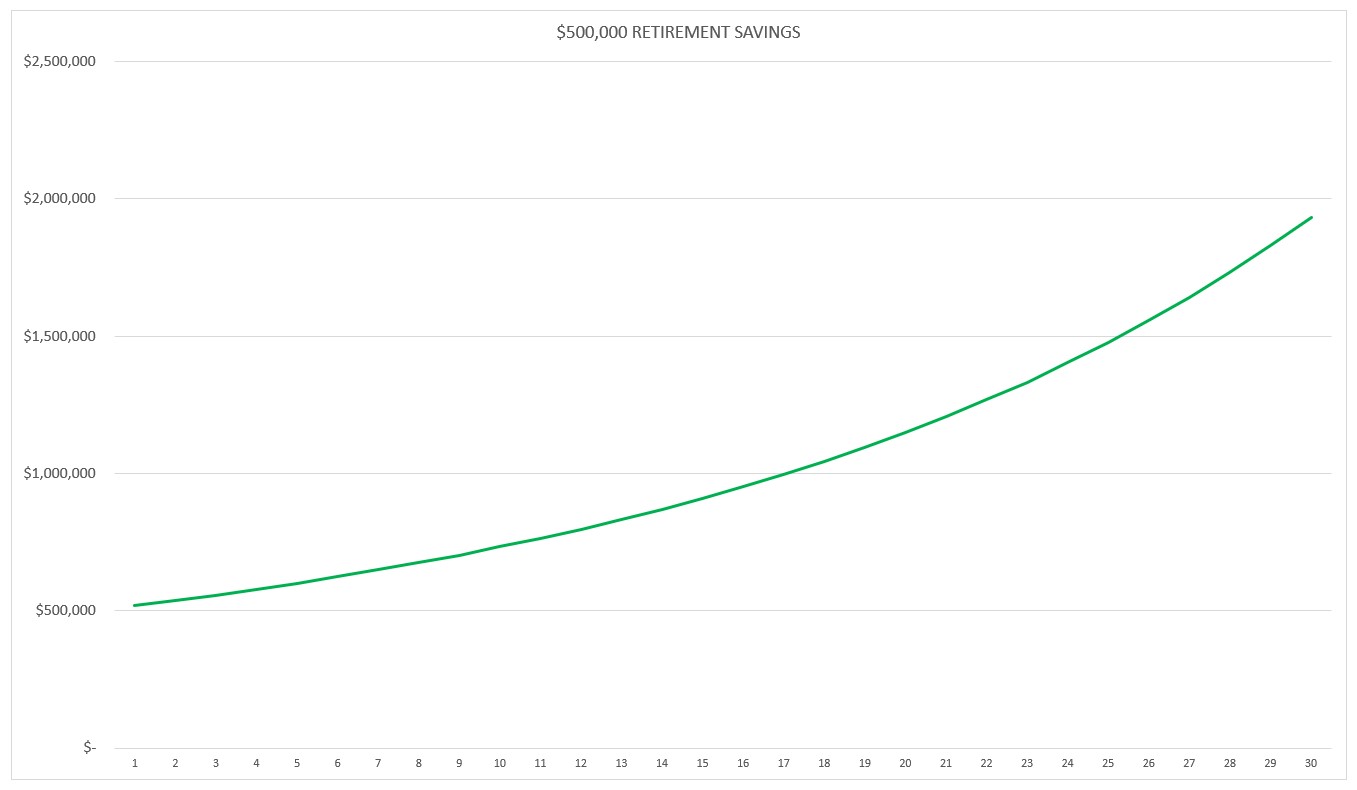

Well, you might say, he obviously didn’t need $1,000,000. Fine, let’s do it again. This time we’ll start with half as much, $500.000. All other things being equal, Mr. Bozo withdraws $20,000 in his first year of retirement (0.04 x $500,000) and continues to make inflation-adjusted withdrawals for 30 years. Here is the revised graph of Mr. Bozo’s retirement account:

This time Mr. Bozo ends up with almost $2,000,000 in retirement savings. Obviously, the problem is not with how much Mr. Bozo has in his retirement account, the problem is the 4% rule.

Remember the rule’s objective? As long as you don’t withdraw more than 4% per year from your retirement savings, you will never run out of money. It's safe to say, mission accomplished!

While not running out of money in retirement is an important goal, it’s better to save the right amount and enjoy your life. Who wants to live their life like a pauper only to find that you have more money in retirement than you need? Leaving an inheritance for your heirs is an admirable goal, but four times what you started with is crazy.

How much should you save for retirement and what amount can be safely withdrawn each year? You can find the answer for your situation with financial modeling software. To learn more, check out this article entitled Best Retirement Planning Software.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.