Mike Ballew – Financial Planning Association member, engineer, author, and founder at Eggstack.

Eggstack is an independent financial technology company located in Jacksonville, Florida. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.

Are you drowning in debt or know someone who is? Are bills piling up from credit card companies, medical service providers, auto loans, or personal loans? Did you know there is a fast and easy way out that can simplify your finances and improve your credit? See how debt consolidation can save you from financial ruin.

Debt Consolidation is a simple solution that can save money on interest and help pay off your debt. You can increase your credit score by moving debt from credit cards to a personal loan. The big three credit bureaus categorize credit cards as revolving debt. A high amount of revolving debt (typically more than 30 percent of available credit) can lower your credit score. A debt consolidation loan is considered a personal loan. Personal loans have less impact on your credit score.

A debt consolidation loan can save you money. You can get out of debt sooner and for less money than you would otherwise. Savings come in the form of reduced interest rates, lower monthly payments, and a reduction in overall debt.

Unlike a personal loan where interest accrues on a monthly basis, credit card interest accrues on a daily basis. On the first day of the month, interest is charged on your outstanding balance. The next day, interest is charged on your outstanding balance plus the interest charged on the day before. It goes on like that for the entire month, each day charging interest on the accumulated interest.

Simply put, credit cards are the absolute worst place to keep debt. You can improve your financial standing by moving credit card balances into a debt consolidation loan.

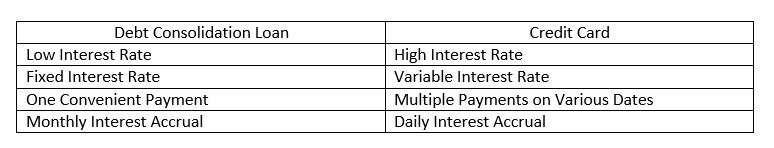

A debt consolidation loan has a number of benefits over conventional credit card debt. This table lists the major benefits of a debt consolidation loan compared to credit card debt:

A debt consolidation loan can combine all of your existing personal debt into one loan with a lower interest rate and smaller monthly payments. Consolidating your debt into a single loan will decrease your utilization ratio which typically results in a significant improvement in your credit score.

Let’s look at an example. Suppose you have a total balance of $15,000 scattered among several credit cards. The APR on the cards is 17.9%. If you keep paying the minimum monthly payments on those cards, it will take you 25 years to pay them off. In the process, you will have paid almost $15,000 in interest. Does that sound smart to you?

By moving the $15,000 debt into a debt consolidation loan with an APR of 9%, your debt can be paid off in 3 years and you will pay only $2,172 in interest.

If you have debt with high interest rates and daily interest accrual, a debt consolidation loan is right for you. If you or someone you know is in serious trouble with debt and struggling with harassing phone calls from debt collectors, a debt consolidation loan can help. Debt consolidation combined with credit counseling can have you paying off your debt much sooner at a fraction of the cost.

Photo credit: Pixabay Eggstack News will never post an article influenced by an outside company or advertiser. Our mission is to help you overcome uncertainty about retirement planning and inspire confidence in your financial future.