Best Retirement Planning Software

Did you know the average American spends more time planning a single vacation than they do their entire retirement? Retirement is the last chapter of your life, you owe it to yourself to make it the best it can be!

Don’t be fooled into thinking you can't do your own retirement planning. Self-directed retirement planning is easy with the right tools.

Program Types

Many online retirement calculators are based on retirement rules of thumb. These one-size-fits-all solutions use so many assumptions the results are virtually meaningless. Retirement planning is too important to be based on a rule of thumb.

Sophisticated retirement planning software considers various aspects specific to your unique financial situation. A financial model is built based on your entries which is used to run year-by-year simulations. These types of programs represent a significant improvement over rule-of-thumb retirement calculators.

Evaluation Criteria

The following criteria was used to evaluate these 7 retirement planning applications:

Simplicity: The art of design is simplicity. No one likes a steep learning curve. Lengthy user manuals and tedious tutorial videos are clear signs of poor design.

Integrity: Commercial ventures exist to make a profit, but some go about it in a questionable manner. Retirement planning software that is difficult to use and understand may be intentionally made that way. The goal is to get you to click on the many advertisements for financial advisers who in turn pay the website for leads.

Security: Online security is critical to any application. Retirement planning software that requests sensitive data or asks for login credentials to your retirement accounts is rife with opportunities for hacking.

Depth: A measure of how well the application addresses the entire scope of retirement planning.

Eggstack Review

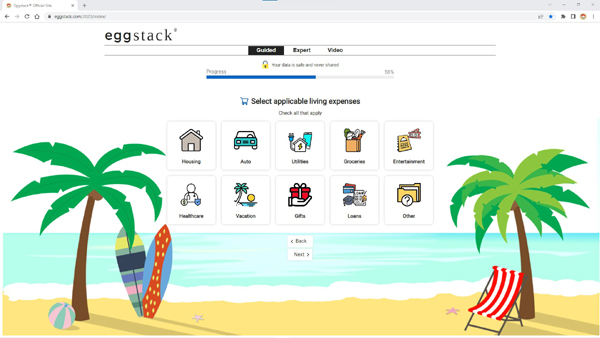

#1 Eggstack

Best Overall Retirement Planning Software

Positives: A true standout in terms of design and analysis.

Rating (1–10): 10

One word: Excellent.

Price: Free trial, $7.49 month-to-month subscription.

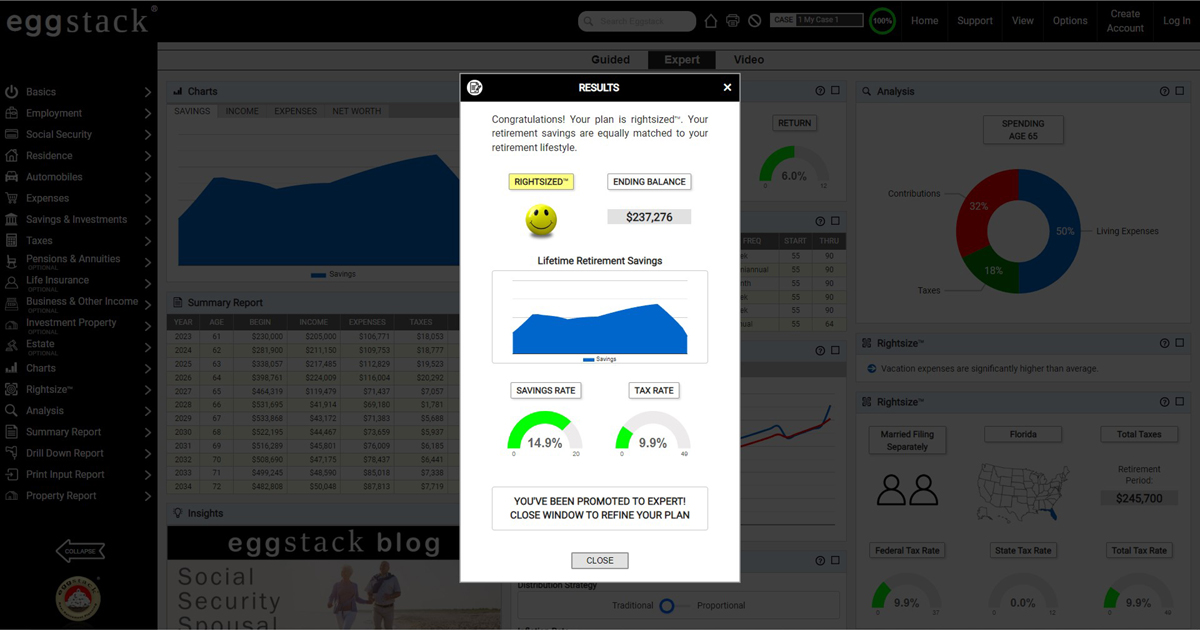

Eggstack is well-suited to both casual users and hardcore number crunchers. Its intuitive design belies the complexity of the comprehensive analysis taking place under the hood. Eggstack considers virtually everything that could affect your retirement plan, and it does so without feeling tedious or overwhelming.

Eggstack predicts how much money you will have leftover at life expectancy and plots a chart of your retirement savings over time. You can change any part of your plan and instantly see the results. You can explore "what if" scenarios such as buying your dream home, downsizing to one car in retirement, or moving to a different state.

Eggstack calculates your state and federal income taxes for each year in the simulation. It lists detailed results for every year both in a Summary Report and the more granular Tabulated Results.

One unique feature that we liked was the ending balance meter. It shows whether you have too little, too much, or just the right amount of retirement savings:

Eggstack offers a host of optional advanced features including Monte Carlo simulation, Roth conversions, investment properties, business income, annuities, portfolio rebalancing, alternate distribution strategies, Social Security insolvency, reverse mortgages, whole life insurance and more. The Case Manager allows you to compare multiple scenarios and you can print out your results.

Based on the evaluation criteria, here's how Eggstack stacks up:

Simplicity: Eggstack has a simple interface with controls that are easy to use and understand.

Integrity: Eggstack doesn’t try to sell you anything. There are no ads or gimmicks.

Security: The site is secure. The privacy policy states: "No one can hack your sensitive data because Eggstack doesn’t ask for any. Nothing you enter can be tied to you in any way."

Depth: Eggstack considers everything that could affect your retirement plan.

Overall, Eggstack is an outstanding retirement planning tool.

PRO

Performs year-by-year simulation.

Easy to use with clear results.

No sensitive personal data.

Calculates state and federal taxes.

CON

Immersive depth.

Wealthtrace Review

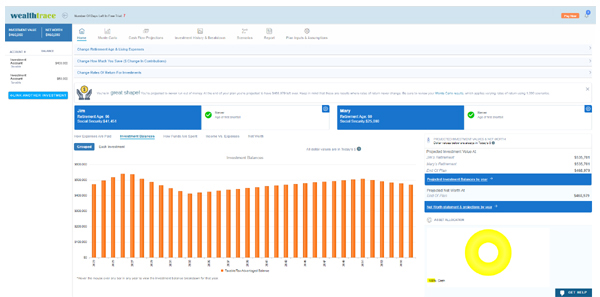

#2 WealthTrace Retirement Planning Software

Positives: Thorough analysis with good reports.

Rating (1–10): 8

One word: Impressive.

Price: Free trial, $229-$289 annual subscription.

WealthTrace is a relatively easy-to-use retirement planner with intuitive controls and good navigation. Each input page has a limited number of entries which keeps it from feeling overwhelming. Both the graphics and the reports are attractive and easy to read. WealthTrace offers the option to estimate Social Security benefits based on your income.

That said, WealthTrace does request some potentially sensitive information. It asks for your first and last name, your birthdate, and that of your spouse (as applicable). It also wants to link to your retirement accounts. While the intent is convenience, it’s questionable whether the convenience is worth the risk. Fortunately, WealthTrace allows you to manually enter your account balances. Opting for manual entry helps maintain the security of your retirement accounts.

WealthTrace asks for your retirement date, which takes some figuring. It would be better if it asked for your retirement age. It also asks you to estimate your state income tax. When you click Help, it takes you to another website (SmartAsset) which is riddled with ads.

You may also experience some wonkiness on the site. There were a few instances where the program hung and did not respond to pressing Save or Next. For some reason, it set the spouse’s salary to $3,000,000. Dragging the slider back down to earth resulted in a tiny fraction usable to set the correct amount.

Overall, WealthTrace does a good job and is a solid retirement planning application.

Simplicity: WealthTrace has a decent interface with controls that are generally easy to use and understand.

Integrity: WealthTrace does not try to sell you anything or get you to sign up for a financial advisor.

Security: Requires you to enter first and last name and birthdate for yourself and your spouse (as applicable). Also requests to link to your financial accounts but allows manual entry.

Depth: WealthTrace covers a broad spectrum of issues that can affect your retirement plan.

PRO

Performs year-by-year simulation.

Ease of use and navigation.

Attractive site and reports.

CON

Requires you to estimate your taxes.

More expensive than other options.

New Retirement Review

Boldin Review

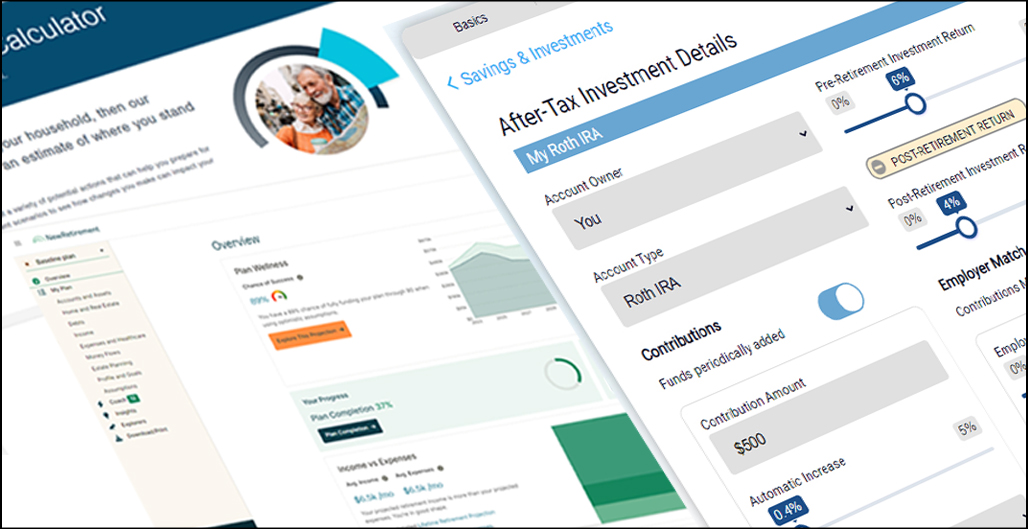

#3 Boldin (formerly New Retirement)

Positives: Performs year-by-year simulation.

Rating (1–10): 4

One word: Confusing.

Price: Free trial, $120 annual subscription.

As you enter the Boldin site, you are asked to input basic information such as your date of birth and that of your spouse (as applicable), then it’s on to a series of entries arranged by subject matter. Investment returns are categorized as Optimistic set at 5% and Pessimistic set at 2%. The investment returns are grayed out and do not appear to be adjustable. 2-5% seems low, especially when you cannot make any adjustments. When entering information about your investment accounts, it directs you to a different page to enter your contributions. It seems like that should be on the same page.

One major fail is the assumption that pre-retirement income that exceeds your living expenses automatically goes towards retirement savings. In a perfect world, that would be the case. In the real world, more often than not extra cash in your working years is spent on vacations, cars, boats, and the like. No doubt many users miss this assumption and walk away thinking they have a successful plan, when in fact they are not saving enough.

It soon becomes clear that Boldin requires entries down to the month and year. Besides quickly becoming tiresome, entering data to this level of detail implies a degree of accuracy that does not exist in a predictive tool that looks out over decades of time. The concept seems misguided and ill-conceived.

One thing Boldin does well is preview the features that would be available if you upgrade to PlannerPlus. There are numerous blurred out charts and other analysis.

The Classroom button takes you to a page filled with video tutorials. The first, entitled Lesson 1: Welcome and Introduction, is over 8 hours in length and comes with a 100-page workbook. For an introductory course, this seems excessive.

There are buttons throughout the Boldin site with labels such as Meet 1:1 With a Planning Coach and Upgrade to PlannerPlus. When you click the Expertise button, it takes you to the Boldin Financial Advisor Page. There you can sign up for coaching sessions at $175 per hour or schedule a financial planning meeting for $1,500.

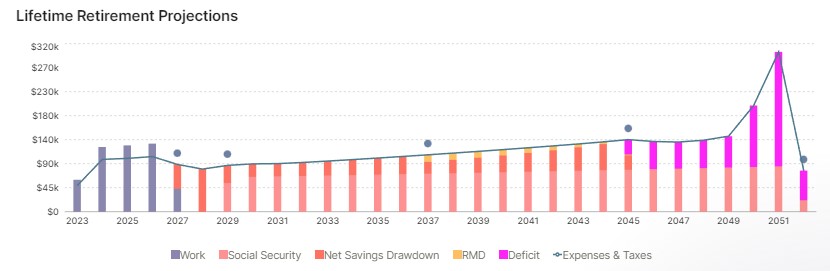

After your data has been entered, it can be difficult to find the results. One chart is located on the Overview page and another is tucked away on the Lifetime Income Projection page. These charts can be confusing.

Overall, Boldin is unyielding and difficult to use. The output is hard to decipher and the pervasive upselling is annoying at best.

Simplicity: Boldin is more complicated than it needs to be.

Integrity: Confusing output coupled with pervasive upselling raises questions.

Security: Boldin seems reasonably secure.

Depth: The program has more depth than some others reviewed.

PRO

Performs year-by-year simulation.

Good depth.

CON

Confusing output.

Pervasive upselling.

Lengthy tutorial videos.

T. Rowe Price Retirement Income Calculator Review

#4 T. Rowe Price Retirement Income Calculator

Positives: It’s free.

Rating (1–10): 3

One word: Disappointing.

The old adage “You get what you pay for” was never more true than with the T. Rowe Price Retirement Income Calculator . What is remarkable is that it is so widely-recommended across the financial blogosphere.

There are only a few pages but each one is full of questions. It can be overwhelming. It asks for annual employment income but doesn’t specify whether it’s gross or net. When entering data in the input fields, a phantom zero remains. When you hit Enter, it doesn’t take your input, you have to click somewhere outside the box.

It’s odd that in this day and age, the T. Rowe Price Retirement Income Calculator requires you to specify your gender and that of your spouse. In the middle of asking for employment and savings data, it asks what state you live in. It just asked that on the previous page.

After entering standard middle-class data, the Results page indicated the plan had zero chance of success. It turns out that the calculator automatically sets your annual living expenses equal to your annual income. When trying to save for retirement, that would cause a problem. The question is, why would it do that? Why would the default behavior be to shock every user by telling them their plan has zero chance of success?

The only output is a gauge that displays probability of success. No retirement savings chart, no table of calculated values.

When you are finished, it asks you to open an investment account and sign up to “Talk to one of our Investment Specialists today.”

Overall, the T. Rowe Price Retirement Income Calculator is disappointing. It makes numerous assumptions, we found no way to adjust inflation, set investment returns, or specify tax filing status.

The site asks a lot of rhetorical questions like, “Are you on track?” and “Will you be in the retirement Confidence Zone?” Using this calculator, you may never know.

Simplicity: The T. Rowe Price Retirement Income Calculator is easy to navigate.

Integrity: One pitch to connect with an investment advisor, but given that T. Rowe Price is an investment company, it should be expected.

Security: Asks for you and your spouse's birthdate and gender.

Depth: With just one output, it lacks depth.

PRO

Free.

CON

Lacks depth.

Interface does not appear to be well thought out.

Lacks charts and tables.

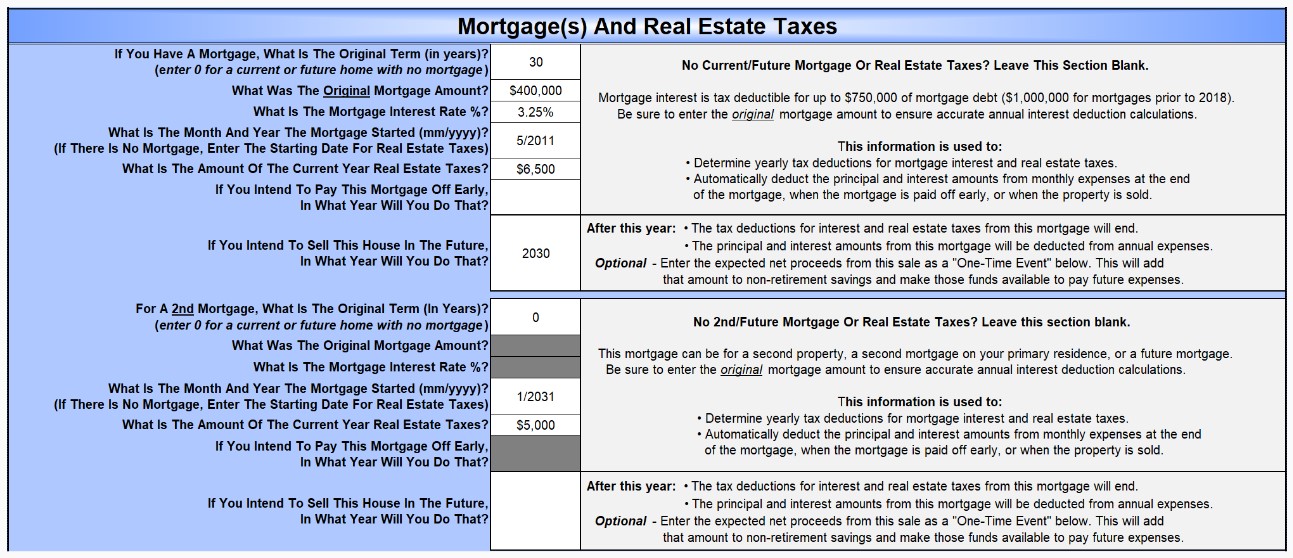

The Complete Retirement Planner Review

#5 The Complete Retirement Planner

Positives: Nice images.

Rating (1–10): 3

One word: Spreadsheet.

Price: $90 download.

The Complete Retirement Planner is an Excel spreadsheet. As such, the interactivity compared to online tools is rather limited. The input pages, as shown below, are very tedious.

Simplicity: Tedious input pages.

Integrity: Nothing questionable.

Security: It appears secure.

Depth: The Complete Retirement Planner goes into some depth.

PRO

Website has nice images.

CON

It’s a spreadsheet.

No free trial.

Limited interactivity.

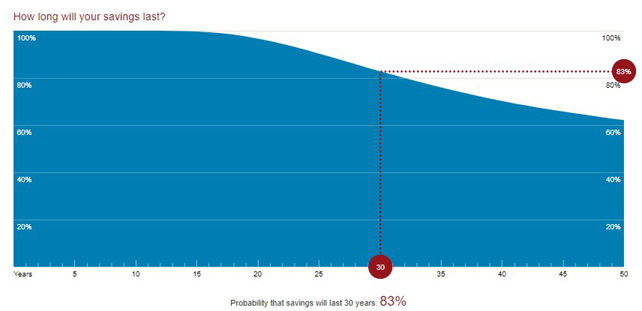

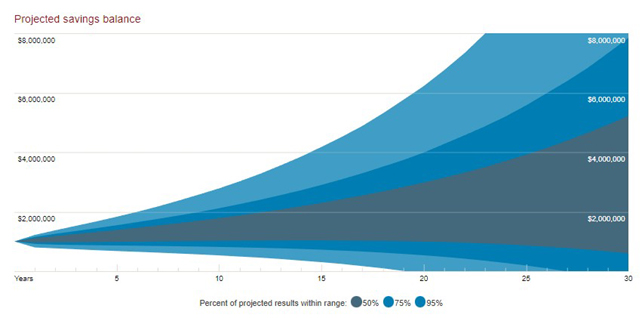

Vanguard Retirement Nest Egg Calculator Review

#6 Vanguard Retirement Nest Egg Calculator

Positives: Attractive graphics.

Rating (1–10): 2

One word: Lacking.

The Vanguard Retirement Nest Egg Calculator is a much-lauded retirement planning tool in financial circles. When you use it, one question comes to mind: Why? Other than the fact that it bears the Vanguard name, this is a very limited calculator.

The Vanguard Retirement Nest Egg Calculator asks how many years your retirement savings should last, your current savings, and how much you spend each year. There is an arc-slider that allows you to indicate how your retirement savings are divided between stocks, bonds, and cash.

The calculator outputs two charts which are a little confusing. One shows chance of success versus retirement period, and the other displays projected savings versus retirement period:

The Vanguard Retirement Nest Egg Calculator is lacking in several key areas. One is intuitive and easy-to-understand output. It’s not. You could spend hours studying those charts and still not know what you’re looking at.

There are numerous factors the calculator fails to consider. There is no mention of Social Security benefits, taxes, or inflation – to name a few.

Overall, the Vanguard Retirement Nest Egg Calculator comes up short. While it does a good job of predicting the odds that X dollars will last Y years, there is much more to retirement planning than that. In terms of being a comprehensive retirement planning tool, it falls short.

Simplicity: It’s simple.

Integrity: Doesn’t seem to be selling anything.

Security: No problems there.

Depth: Lacking.

PRO

It looks good.

CON

Lacks depth.

Fails to consider numerous important factors.

Empower Online Retirement Planner Review

#7 Empower (formerly Personal Capital Online Retirement Planner)

Positives: Sentence-style fill-in-the-blank input fields.

Rating (1–10): 1

One word: Unfortunate.

Empower, formerly known as Personal Capital Online Retirement Planner, is a well-known and widely-praised retirement planning tool. The sentence-style fill-in-the-blank inputs are a nice touch. In two simple sentences, the first page acquires your name, age, retirement age, and current savings.

Personal Capital was purchased by Empower in 2020. Empower, a financial services company, completed the rebranding in 2023.

Like some of the other retirement planning applications reviewed, this one comes right out the box asking for sensitive data; specifically, your email address and phone number. Next to where you enter your phone number it states: “By providing your phone number and clicking Next, you agree to receive marketing calls and text messages.”

That’s a new one. None of the other planning applications have any such statement.

The second page begins asking questions about how you manage your investments and why you manage them that way. It’s almost as if they are trying to get inside your head. You start thinking maybe that statement by your phone number really means someone is going to call.

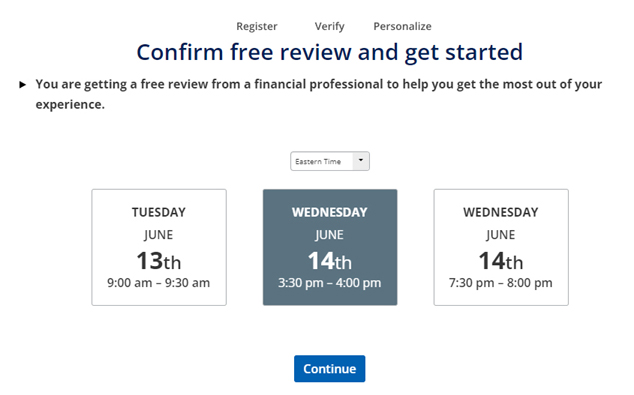

The third page confirms it:

It seems in the course of Empower acquiring the Personal Capital Online Retirement Planner, they turned it into a sales tool. It’s enough to give self-directed retirement planning a bad name.

Integrity: The site appears to have become a sales tool for financial services marketers.

PRO

Sentence-style data input.

CON

Requires your phone number and a salesperson will call.

Conclusion

There’s nothing quite like rolling up your sleeves and doing it yourself. It’s the best way to understand everything involved for a successful outcome.

You were advised in the introduction to avoid rule-of-thumb retirement calculators, but how can you tell? Rule-of-thumb calculators typically ask three questions: 1) age, 2) income, and 3) current savings. If it doesn’t ask more than that, it’s making assumptions and using a rule of thumb.

It pays to shop around. You are encouraged to perform your own investigation and seek other points of view before coming to any conclusions.