Overall Progress

Savings & Investments

Monte Carlo Simulation

PROBABILITY OF SUCCESS:

Savings & Investments

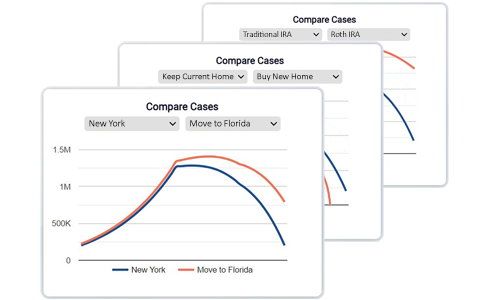

Compare Cases

ENDING BALANCE

Income

Financial Obligations

Asset Allocation

Distributions

Assets

Liabilities

Net Worth

Retirement Income

Retirement Expenses

Retirement Assets

USE ASSUMPTIONS

Let's get started!

Enter data based on your actual finances or use assumptions you can change later

Enter Data

Your information

10 minutes

10 minutes

Use Assumptions

3 questions

1 minute

1 minute

3 questions, you got this!

PLAN BASIS

AGE

INCOME

BEFORE

RETIREMENT

Eggstack needs some basic information to get started. Your data is safe and never shared.

Would you like to plan as an individual or couple?

Individual/Couple

About you

Name

Age

Retirement Age

Life Expectancy

About your partner

Partner's Name

Partner's Age

Partner's Retirement Age

Partner's Life Expectancy

HIDDEN

HIDDEN

Eggstack calculates taxes based on IRS tax code and the tax laws in your state.

How do you file your taxes?

Tax Filing Status

Live Separately?

State of residence

State Income Tax Basis

ADD STATE

ADD STATE

State Details

State Start/Thru Age

Income

Gross Income

Pay Period

Social Security

Age Start

Monthly Benefit at Full Retirement Age

OFF

Social Security Insolvency

NONE

Business/Other Income

Additional Income

ADD BUSINESS

ADD BUSINESS

Business/Other Income Details

Income Type

Alimony Indexed for Inflation

Income Amount

Intrinsic Value

Income Frequency

Annual Rate of Change

Income Start/Thru Age

Married Filing Separately Proportion

PRE-TAX

AFTER-TAX

TAXABLE

PRE-TAX ACCOUNTS

Traditional 401(k), 403(b), 457(b), TSP, Traditional IRA, SEP IRA, SIMPLE IRA, Solo 401(k)

Account Name

Account Balance

ADD ACCOUNT

ADD ACCOUNT

AFTER-TAX ACCOUNTS

Roth 401(k), Roth 403(b), Roth 457(b), Roth TSP, Roth IRA, HSA, Solo Roth 401(k)

Account Name

Account Balance

ADD ACCOUNT

ADD ACCOUNT

TAXABLE ACCOUNTS

Stocks, Bonds, Mutual Funds, CDs, Money Market Accounts, Savings Accounts

Account Name

Account Balance

ADD ACCOUNT

ADD ACCOUNT

Pre-Tax Investment Details

Account Type

Contributions

Funds periodically added

EXCEEDS LIMIT

Automatic Increase

Contribution Frequency

Contribution Age Start/Thru

OFF

Portfolio Rebalancing

Portfolio Account Designation

Rebalancing Method

Portfolio Ratio Drift

OFF

Monte Carlo Simulation

Asset Class

MEAN RETURN

STANDARD DEVIATION

Investment Return

SAME

Post-Retirement Investment Return

Employer Match

Contributions Matched

Employer Match Percent

Employer Match Cap

NONE

Investment Loan

Existing or New?

Loan Balance

Loan Payment Amount

Loan Payment Frequency

Loan Age Start/Thru

NONE

Roth Conversion

Roth Conversion Amount

Roth Conversion Type

Roth Conversion Tax Source

Roth Conversion Age

After-Tax Investment Details

Account Type

Contributions

Funds periodically added

EXCEEDS LIMIT

Contribution Amount

Automatic Increase

Contribution Frequency

Contribution Age Start/Thru

OFF

Portfolio Rebalancing

Portfolio Account Designation

Rebalancing Method

Portfolio Ratio Drift

OFF

Monte Carlo Simulation

Asset Class

MEAN RETURN

STANDARD DEVIATION

Investment Return

SAME

Post-Retirement Investment Return

Employer Match

Contributions Matched

Employer Match Percent

Employer Match Cap

Current Pre-Tax Portion of Account Balance

Taxable Investment Details

Account Type

Contributions

Funds periodically added

Contribution Amount

Automatic Increase

Contribution Frequency

Contribution Age Start/Thru

OFF

Portfolio Rebalancing

Portfolio Account Designation

Rebalancing Method

Portfolio Ratio Drift

OFF

Monte Carlo Simulation

Asset Class

MEAN RETURN

STANDARD DEVIATION

Investment Return

SAME

Post-Retirement Investment Return

NONE

Dividends

Dividend Amount

Dividends Reinvested?

NONE

NONE

Pensions

ADD PENSION

ADD PENSION

NONE

Annuities

ADD ANNUITY

ADD ANNUITY

NONE

Life Insurance

ADD INSURANCE

ADD INSURANCE

NONE

Investment Property

ADD INVESTMENT PROPERTY

ADD INVESTMENT PROPERTY

Pension Details

Pension Amount

Pension Payment Frequency

Pension Age Start/Thru

Annuity Details

New or Existing?

Annuity Type

Annual Return

Annuity Tax Basis

QLAC

Rollover?

Rollover Source

ACCOUNT

Rollover Amount

EXCEEDS LIMIT

Annuity Distribution Type

Annuity Period Certain

Annuity Premiums

Periodic amount you pay

Annuity Payments

Annuity Payment Amount

Annuity Payment Frequency

Annuity Payment Age Start

Life Insurance Details

Face Value

Cash Value

Planned Cash-In

Policy Type

Benefit Type

Premium Amount

Premium Frequency

Dividends

Dividend Amount

Dividend Destination

Guaranteed Rate of Return

Estimated Rate of Return

NONE

Loan

Existing or New?

Loan Balance

Loan Payment Amount

Loan Payment Frequency

Loan Age Start/Thru

Investment Property Details

Year of Purchase/Sale

Purchase Price

Land Value

Property Improvements

Mortgage

Property mortgage

Mortgage

Initial Mortgage Balance

Total Mortgage Term

Mortgage Interest Rate

Married Filing Separately Proportion

Monthly Rent

Annual Rent Increase

Months Vacant

Annual Property Taxes

Annual Homeowners Insurance

Annual HOA Fees

Annual Repairs & Maintenance

Other Annual Costs

Realtor Commission

Seller’s Closing Costs

Do You Rent or Own?

Monthly Rent

Purchased Home Name

Monthly Mortgage Payment

ADD RESIDENCE

ADD RESIDENCE

Residence Details

Age Start/Thru

Mortgage

Home mortgage

Annual Property Taxes

Annual Homeowners Insurance

NONE

Reverse Mortgage

Reverse Mortgage Payments

Distribution Frequency

Reverse Mortgage Age Start

Term

Years

Vehicles

Number of Vehicles

Own or Lease?

HIDDEN

Years Kept Typical Vehicle

Years Kept Current Vehicle

Cash or Loan?

Typical Loan Term

Downsize in Retirement

One vehicle in retirement

Expenses

Expense Name

Expense Amount

ADD EXPENSE

ADD EXPENSE

Enter living expenses as one combined value

OFF

Combined Monthly Expenses

Combined Monthly Expenses

Expense Amount

Expense Type

Alimony Paid

Who Pays?

Inflation-Adjusted?

Payment Frequency

Ending Balance

RETIREMENT SAVINGS AT PLAN END

ENDING BALANCE

$0

Investment Returns

SUMMARY REPORT

TABULATED RESULTS

PREDOMINANT RETIREMENT STATE

Retirement Tax Rate

PROPERTY REPORT

Retirement Taxes

TOTAL RETIREMENT PERIOD TAXES

$0

Savings Rate

Summary Report

Age

| Annual Summary |

| Beginning Balance |

| Investment Contributions |

| Investment Growth |

| Income |

| Expenses |

| Taxes |

| Distributions |

| Ending Balance |

Tabulated Results

Age

| YEAR START |

| Pre-Tax Beginning Balance |

| Pre-Tax Beginning Balance |

| Pre-Tax Loan Balance |

| Pre-Tax Loan Balance |

| After-Tax Beginning Balance |

| After-Tax Beginning Balance |

| Taxable Beginning Balance |

| Taxable Beginning Balance |

| Virtual Account Beginning Balance |

| Year Start |

| SAVINGS & INVESTMENTS |

| Pre-Tax Personal Contributions |

| Pre-Tax Personal Contributions |

| After-Tax Personal Contributions |

| After-Tax Personal Contributions |

| Taxable Personal Contributions |

| Taxable Personal Contributions |

| Total Personal Contributions |

| Pre-Tax Employer Contributions |

| Pre-Tax Employer Contributions |

| After-Tax Employer Contributions |

| After-Tax Employer Contributions |

| Total Employer Contributions |

| Pre-Tax Investment Returns |

| Pre-Tax Investment Returns |

| After-Tax Investment Returns |

| After-Tax Investment Returns |

| Taxable Investment Returns |

| Taxable Investment Returns |

| Virtual Account Returns |

| Total Investment Growth |

| INCOME |

| Gross Earned Income |

| Gross Earned Income |

| Total Gross Earned Income |

| Scheduled Social Security Benefits |

| Scheduled Social Security Benefits |

| Social Security Reduction: Earned Income |

| Social Security Reduction: Earned Income |

| Social Security Reduction: Insolvency |

| Social Security Reduction: Insolvency |

| Total Social Security Benefits |

| Pension Benefits |

| Pension Benefits |

| Annuity Distributions |

| Annuity Distributions |

| Business & Other Income |

| Home Sale |

| Investment Property |

| Reverse Mortgage |

| Loan Proceeds |

| Loan Proceeds |

| Dividends |

| Dividends |

| Life Insurance |

| Life Insurance |

| Total Income |

| FINANCIAL OBLIGATIONS |

| Residence Purchase |

| Residence Payments |

| Housing Expenses |

| Vehicle Purchase |

| Vehicle Payments |

| Transportation Expenses |

| Groceries |

| Healthcare |

| Entertainment |

| Vacation |

| Donations |

| Gifts |

| Alimony Paid |

| Other Expenses |

| Annuity Premiums |

| Life Insurance Premiums |

| Investment Contributions |

| Payroll Withholdings |

| Investment Loan Payments |

| Life Insurance Loan Payments |

| Total Financial Obligations |

| TAXES |

| Federal Tax Social Security Benefits |

| State Tax Social Security Benefits |

| Federal Tax Ordinary Income |

| State Tax Ordinary Income |

| Federal Tax Long-Term Capital Gains |

| State Tax Long-Term Capital Gains |

| Federal Tax RMDs |

| State Tax RMDs |

| Federal Penalty for Early Withdrawal |

| State Penalty for Early Withdrawal |

| Federal Tax |

| State Tax |

| Federal Effective Tax Rate |

| State Effective Tax Rate |

| Total Taxes |

| DISTRIBUTIONS |

| RMDs |

| RMDs |

| Pre-Tax over RMDs |

| Pre-Tax over RMDs |

| After-Tax Distributions |

| After-Tax Distributions |

| Taxable Distributions |

| Taxable Distributions |

| Virtual Account Distribution |

| Total Distributions |

| YEAR END |

| Pre-Tax Ending Balance |

| Pre-Tax Ending Balance |

| Pre-Tax Ending Loan Balance |

| Pre-Tax Ending Loan Balance |

| After-Tax Ending Balance |

| After-Tax Ending Balance |

| Taxable Ending Balance |

| Taxable Ending Balance |

| Virtual Account Ending Balance |

| Home Sale to Taxable Investments |

| QLAC Rollover |

| Year End |

Investment Property Report

Age

Investment Property

PROPERTY

| TAX BASIS |

| Rent Received |

| Property Sale |

| Total Annual Income |

| Depreciation |

| Loan Interest |

| Property Taxes |

| Property Insurance |

| HOA Fees |

| Repairs & Maintenance |

| Other Costs |

| Realtor Commission |

| Seller's Closing Costs |

| Total Annual Costs |

| Total Net Profit (Loss) |

| All Properties Profit (Loss) |

| CASH BASIS |

| Rent Received |

| Property Sale |

| Total Annual Income |

| Principal Paid |

| Loan Interest |

| Property Taxes |

| Property Insurance |

| HOA Fees |

| Repairs & Maintenance |

| Other Costs |

| Realtor Commission |

| Seller's Closing Costs |

| Total Annual Costs |

| Total Net Profit (Loss) |

| All Properties Profit (Loss) |

Privacy policy

Copyright © 2018 - 2024 Eggstack

Terms of use

LIFE EXPECTANCY

LIFE EXPECTANCY

TAX BASICS

TAX BASICS

July 27, 2024

July 27, 2024